“The results of the first half of the year demonstrate the resilience of the Group despite the unprecedented conditions in which it operates on an economic and geopolitical level, said the President and CEO of PPC SA. Mr. Georgios Stassis

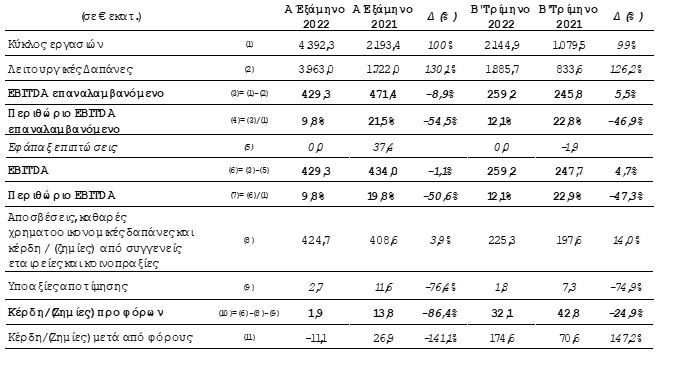

Despite the large increase in operating expenses, and mainly the expenses for energy purchases and for natural gas, which is basically due to the extremely high natural gas prices that push up the prices in the wholesale market, the operating profitability of the PPC Group showed resilience with earnings before interest, taxes and depreciation (EBITDA) on a recurring basis to be €429.3 million in the first half of 2022, showing a decrease of €42.1 million (-8.9%) compared to the corresponding period last year period, with the corresponding margin being 9.8%.

At the level of the individual activities, the operating performance of Emporia was adversely affected by the aforementioned reasons and the conditions that prevailed in the electricity market. This negative impact was largely compensated by the improvement of the Production profit margin, which contributed so that PPC remained loyal to the support of its customers.

The pre-tax results amounted to profits of €1.9 million compared to profits of €13.8 million in the first half of 2021.

The results after taxes amounted to losses of €11.1 million against profits of €26.9 million in the first half of 2021.

Commenting on the financial results, the President and CEO of PPC S.A. Mr. Georgios Stassis stated:

“The results of the first semester demonstrate the resilience of the Group despite the unprecedented conditions in which it operates on an economic and geopolitical level, while supporting customers with significant discounts and fixed tariffs.

Operating profitability remained within budget targets, while we continued to increase investments to modernize the Distribution Network and increase our strength in Renewable Energy Sources.

As part of our strategy for selective acquisitions in neighboring countries as well as in Greece, we entered into an agreement with Volterra for the acquisition of a portfolio of Renewable Energy Sources projects with a total capacity of 112MW. This is a portfolio we already know well due to our 45% stake in part of it and includes projects both in operation and ready for construction.

At the same time, we are continuing organic growth through the maturation of our existing portfolio of projects in Renewable Energy Sources, securing environmental conditions for another 100MW and proceeding with the announcement of Photovoltaic Parks with a total capacity of 644MW in the Ptolemaida area.

We continue to support our customers to address the energy crisis through awareness campaigns while offering a significantly improved experience and delivering more value through new products and services.

Through the actions we are taking, we confirm our goal of maintaining recurring operating profitability in 2022 at the levels of 2021 and continue our commitment to the implementation of our business plan, which is the only path to weaning off fossil fuels and imported valuations and with multiple benefits for our shareholders, the environment and society.»

Read the News today and get the latest news.

Follow Skai.gr on Google News and be the first to know all the news.

I have worked in the news industry for over 10 years and have been an author at News Bulletin 247 for the past 5 years. I mostly cover technology news and enjoy writing about the latest gadgets and devices. I am also a huge fan of music and enjoy attending live concerts whenever possible.