While revenues are favored by interest rate hikes, the impact on capital quality and the financial environment remains to be seen, Fitch stresses

Slightly better than it expected in December, Fitch now estimates southern European banks’ performance for the whole of 2023. Growth is proving better than the rating agency expected in most of the region’s countries, although analysts warn of second-half risks due to persistent inflation and rising interest rates.

While revenues are favored by interest rate hikes, the impact on capital quality and the financial environment remains to be seen, Fitch stresses.

Especially in Greece, the house estimates that the banks remain on the path of reducing bad loans, but now estimates that the relative index will close the year at 5.5-6%, against previous forecasts for 5%.

Interest income

Fitch’s data shows that interest income has risen significantly for many southern European banks, often around 40% in the first quarter of 2023 compared to last year, to levels higher than analysts expected . The trend reflects the significant increase in the ECB deposit rate (from -0.5% in 2021 to 3.5% in June 2023), the repricing of large volumes of floating rate loans and limited repricing of customer deposits.

As analysts explain, this has accelerated the boost to revenues and operating profits, strengthening banks’ ability to deal with an expected deterioration in asset quality.

Fitch sees NPLs starting to rise in southern Europe, although it notes that increases in unemployment rates have so far been limited, with first-quarter growth broadly better than expected, in a development that underpins asset quality dynamics.

In this context, for Greece, the house has increased its provisions for the charges for bad loans to 80-90 basis points, compared to the 60 basis points it previously predicted. As analysts explain, this is due to the fact that Greek banks are completing some sales of troubled assets and are expected to take advantage of higher profitability to increase bad loan coverage levels.

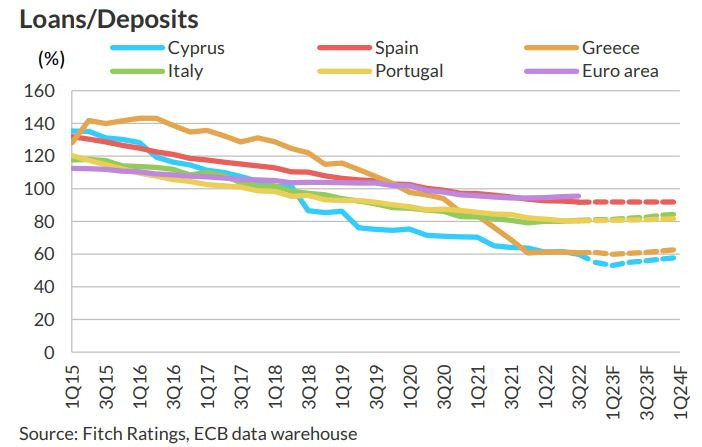

Deposits

As Fitch notes, deposit betas have been very low in Southern European countries, due to the large share of deposits that do not show high pricing sensitivity (mainly household sight deposits) and low competition in deposits.

The shift to term deposits has been limited and most banks have strong deposit networks, with the industry’s pricing names yet to start offering higher interest rates.

In Greece, the rate of pass-through of ECB rate hikes to deposits is very low, Fitch notes, with rates at Spanish levels on household term deposits and still very low on corporate deposits.

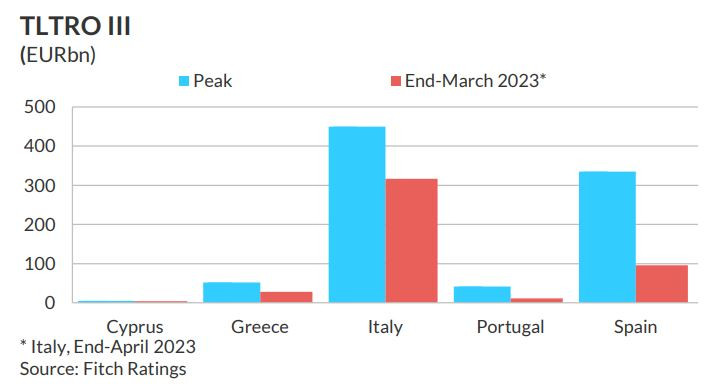

The repayment of the TLTRO

Greek banks have repaid 45% of their original TLTRO loans, with €28 billion remaining at the end of March 2023. With the big four Greek banks holding €42 billion in deposits with the ECB, the TLTRO repayment is expected to comfortable, analysts note.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.