(News Bulletin 247) – This article, with open access, is produced by the stock market analysis and strategy research team at News Bulletin 247. To ensure you don’t miss any opportunities, consult all the analyzes and discover our portfolios by accessing our Privileges area.

Perfectly digesting the latest American inflation figures, the CAC 40 is flying from record to record. The flagship French index, driven by two large weightings (BNP Paribas and Total Energies) gained 0.62% on Tuesday, yet its new zenith in closing data at 8,137.58 points.

“The market seems to have found more comfort in inflation back to around 3%. That said, American growth continues to outperform, in a context where the rigidity of inflation in services and the solidity of the job market are putting highlights the remaining risks in a re-acceleration of the American economy. This robustness should however not hinder the continuation of the disinflation movement”, Lucas MERIC, Investment Strategist at Indosuez WM.

In terms of statistics, operators took note of industrial production in the Euro Zone, in a very clear monthly decline in January (-3.2%), significantly below expectations. Compared to January 2023, the decrease is -6.7%, according to the latest EuroStat data.

On the values side, Vallourec stood out with a gain of 7.4% after announcing an upcoming change in its reference shareholder. The Apollo fund sold its stake of more than 28% to ArcelorMittal. This leads analysts to anticipate a future takeover bid from the steelmaker for Vallourec.

BNP Paribas appreciated by 2.1% after announcing that it expected a higher profit in 2024 than last year, thus surpassing analysts’ expectations.

Accor rose 2.6%, supported by an analyst rating from Jefferies who switched to buy on the file, the financial intermediary having seen potential in several key regions of the company.

On the other side of the Atlantic, the main equity indices ended Tuesday’s session in scattered order, like the Dow Jones (+0.10% to 39,043 points) or the Nasdaq Composite (-0 .54% at 16,177 points). The S&P500, the reference barometer of risk appetite in the eyes of fund managers, contracted very slightly by 0.19% to 5,165 points.

An update on other risky asset classes: around 8:00 a.m. this morning on the foreign exchange market, the single currency was trading at a level close to $1.0940. The barrel of WTI, one of the barometers of the appetite for risk on the financial markets, was trading around $79.40.

On the agenda this Wednesday, to be followed as a priority at 1:30 p.m. for the United States, the producer price index, retail sales and weekly registrations for unemployment benefits. These are all indirect indicators of inflation.

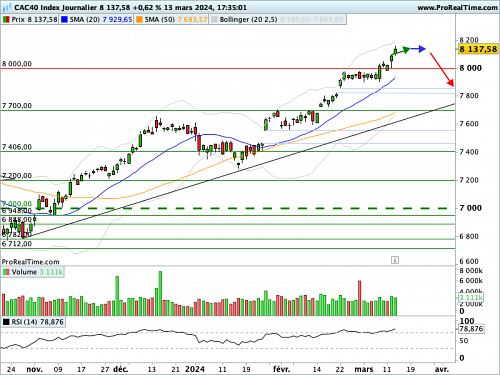

KEY GRAPHIC ELEMENTS

The passing of the symbolic 8,000 points, as significant as it was, was not followed the next day by a bullish extension, and the volumes were relatively timid. The option of consolidation under these recent zeniths remains relevant, without in any way calling into question or doubting the power of trend initial. In the immediate future, reading Japanese candlesticks invites us to very gradually reduce positions.

FORECAST

Considering the key graphical factors that we have identified, our opinion is neutral on the CAC 40 index in the short term.

We will take care to note that crossing 9000.00 points would revive the buying tension. While a break of 8000.00 points would restart the selling pressure.

News Bulletin 247 advice

Hourly graph

Daily Data Chart

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.