(News Bulletin 247) – This article, freely accessible, is produced by the News Bulletin 247 stock market analysis and strategy research team. To not miss any opportunity, consult the full analyses and discover our portfolios by accessing our Privileges area.

The CAC 40 (-0.31% at 7,598 points) limited the damage on Tuesday in the absence of new developments on the geopolitical front. The statistical agenda is still sparse, and in this context, operators focused on corporate activity reports.

The avalanche of quarterly results continues since let us recall that No fewer than 25 CAC 40 companies are publishing their first half-year results this week including 13 on Thursday July 25 alone.

After an emblematic company of the Paris Stock Exchange, and not the least, LVMH, delivered a dull copy. The luxury group delivered its accounts for the first half of 2024, with a profit down on a year. Growth in the second quarter slowed.

Coming back to today’s publications, those of two CAC 40 companies particularly made investors nervous. Thales fell 6.2% after missing the consensus on cash generation in the first half, and slightly lowered its operating margin forecast.

Edenred collapsed by 13.5%, but its fall has left analysts wondering as its results have generally exceeded expectations.

Outside the CAC 40, Interparfums jumped 19.8% after publishing a higher-than-expected activity in the second quarter, and above all announcing the renewal of the Van Cleef & Arpels license about which doubts existed.

Opmobility was also well supported (+9.4%), the former Plastic Omnium having generated profitability and cash flow above expectations in the first half.

Investors are keeping a close eye on the US presidential campaign, as Joe Biden’s decision not to run again could reshuffle the cards. If D Trump remains the favourite, he will have to adapt his strategy in any case.

“This turnaround could allow the Democrats to regain some momentum. One thing is certain, however, the Republican candidate will be forced to change his tune, as his main angle of attack until now has focused mainly on the age and physical and mental capacity of Joe Biden,” explains Thomas Giudici, head of bond management at Auris Gestion.

In terms of statistics, neither the Richmond Fed manufacturing index nor new home sales reached the consensus. The agenda will be expanded this Wednesday, in particular with the very first estimates of the PMI activity barometers for the current month. See you at 10:00 for the synthetic data for the Eurozone. Tomorrow, weekly unemployment benefit registrations and durable goods orders will liven up the session. Friday, the high point will be reached with the PCE (personal consumption expenditures) price index, the Fed’s preferred measure in its assessment of inflation.

The main American stock indices ended Tuesday’s session at levels close to equilibrium, but symbolically in the red, like the Dow Jones (-0.14%) and the Nasdaq Composite (-0.06%). The S&P500, the benchmark barometer of risk appetite in the eyes of fund managers, depreciated slightly, by 0.16% to 5,555 points.

An update on other risky asset classes: around 8:00 this morning on the foreign exchange market, the single currency was trading at a level close to $1,0850. The barrel of WTI, one of the barometers of risk appetite on financial markets, was trading around $77.00.

On the agenda this Wednesday, to follow, essentially, a battery of PMI activity indicators in the Eurozone as in the United States. The German component, published at 9:30 a.m., will be particularly closely followed. As a reminder, these are indicators calculated after analysis by purchasing managers, hence their value as a barometer, an advanced indicator of activity.

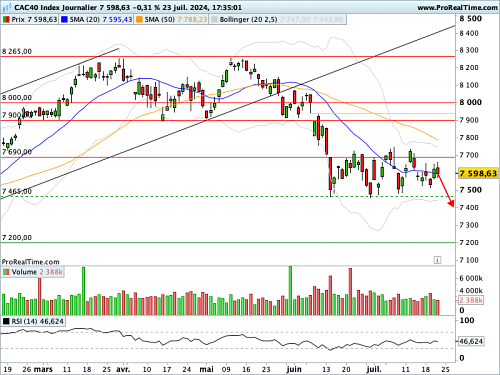

KEY GRAPHIC ELEMENTS

The technical situation remains extremely fragile in the short term, with volatile oscillations expressed in a tidy between 7,465 and 7,700 points. In the event of a break of this first threshold, which corresponds to the lower limit of a former remarkable gap, an additional “purge” movement, the second, would take shape. We are doubling our caution as it approaches. The probabilities of a bottom exit from the tidy are stronger than those of an exit upwards, due to the volumes and volatility at the entry on June 13 and 14.

FORECAST

Considering the key graphic factors that we have mentioned, our opinion is negative on the CAC 40 index in the short term.

This bearish scenario is valid as long as the CAC 40 index is trading below the resistance at 7690.00 points.

The News Bulletin 247 council

Hourly data chart

Daily Data Chart

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.