Higher-than-expected inflation and political noise led to a sharp rise in the interest rate curve. As a result, interest rates on fixed-rate fixed-income securities look very interesting when compared to the rates available at the beginning of 2021. However, inflation is still a concern and investors question whether it is worth taking the risk of fixed rates, or the security of IPCA-referenced bonds is better. I explain below what you need to evaluate to decide.

The future interest curve, traded on the B3 and which is used for pricing fixed-income securities, already suggests that the Selic could exceed 13% per year in mid-2022.

The table below shows, in the second column, the market’s estimate for Selic variations in the next meetings of the Monetary Policy Committee (COPOM) and, in the last column, the expectation of the DI rate after the increase in interest rates. To understand the numbers in the table, 100 basis points of Selic variation is equivalent to a 1% increase.

Note that the rates negotiated in the market already consider that the Selic rate could reach 13.5% per year in June 2022.

Since the end of 2017, Brazilians do not have available rates of return above 10% per annum on fixed income securities. This return seems tempting, but to decide between the prefixed index or the IPCA-referenced indexer, it is necessary to make a difficult bet. Before I explain what the bet is, I’ll give you some details that you should also consider.

The first point to understand is that when comparing fixed-income securities with different remuneration, you should consider the same issuer. Obviously, a public bond that yields Selic will yield less than a post-fixed bond issued by an average bank.

For example, the Treasury Selic bond, due to the custody fee charged by the CBLC of 0.25%, should yield close to 90% of the CDI. An average bank CDB can yield more than 130% of the CDI. This difference in profitability occurs by credit risk from the bank. Those who invest less than R$250 thousand per issuer are guaranteed by the FGC. Therefore, for these cases, the risk is mitigated and the average bank’s CDB is unbeatable in relation to the Treasury Selic.

The same reasoning applies when comparing an average bank CDB fixed or referenced to the IPCA and a Treasury bond with the same remuneration. For the same period, the CDB will probably have greater profitability

However, my aim is to explain how you can decide between fixed-rate and IPCA remuneration. Therefore, I will use National Treasury government bonds for comparison, thus considering the same credit risk.

The decision between the bonds should not only consider the return that is presented today, but what should happen with the movements of COPOM and inflation in the coming years. Understand that a fixed rate bond may seem more advantageous today, but it may lose to Selic, depending on the interest rate changes that COPOM must practice until the bond matures.

We will restrict ourselves, however, to the decision only to the two remunerations: IPCA and fixed rate. The picking process is simple, but, as I mentioned, it will require you to place a bet on what is implicit in the yield curves at each point in time until the bond matures. Anbima’s website helps you with this calculation.

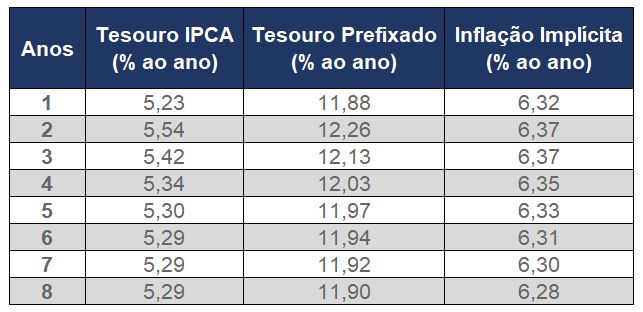

Anbima daily updates the table below, available on the link. In this table you will find the equivalent rate for the IPCA Treasury and the fixed-rate Treasury for each term.

In the last column of this table, there is the inflation rate implicit in the fixed-rate security that makes it equivalent to the one referenced to the IPCA, with the same maturity. The decision between IPCA or fixed rate resides in how its perspective diverges from this implicit inflation.

Let’s use the bonds maturing in five years (2026) to illustrate. If you believe that inflation from today up to five years ahead will be higher than 6.33% per year, you should prefer the inflation-linked bond. But if you think that inflation, over the next five years, will be less than 6.33% per year, you should prefer the fixed rate bond.

The profitability of the fixed-rate security is the composition of the IPCA Treasury rate and the implied inflation. For example, with the fifth year title: 11.97% = (1 + 0.0530) * (1 + 0.0633) – 1.

Therefore, if you believe that inflation over the next five years will be 4% per year, if you buy the inflation-linked security, you will earn 9.51% = (1 + 0.0530) * (1 + 0.04) – 1 Therefore, less than the fixed rate bond yield for the same period today is 11.97% per year.

Otherwise, if you suspect that inflation over the next five years will be only 7% a year, it is better to buy the IPCA-referenced bond. This is because the security referenced to the IPCA will yield 12.67% = (1 + 0.0530) * (1 + 0.07) – 1. Therefore, more than the prefixed security.

As we have seen, the choice process is simple, but to make the right decision, you need to have a good forecast of inflation for the next few years. When in doubt, prefer the security of securities referenced to the IPCA, if you are going to invest with a maturity period exceeding three years.

Michael Viriato is an investment advisor and founding partner of Investor’s House

I have over 8 years of experience in the news industry. I have worked for various news websites and have also written for a few news agencies. I mostly cover healthcare news, but I am also interested in other topics such as politics, business, and entertainment. In my free time, I enjoy writing fiction and spending time with my family and friends.