A new category of trading for professional investors is coming – What the CEO of AXA G. Kontopoulos and the CFO of the group N. Koscoletos said at

By Anna Maroulis

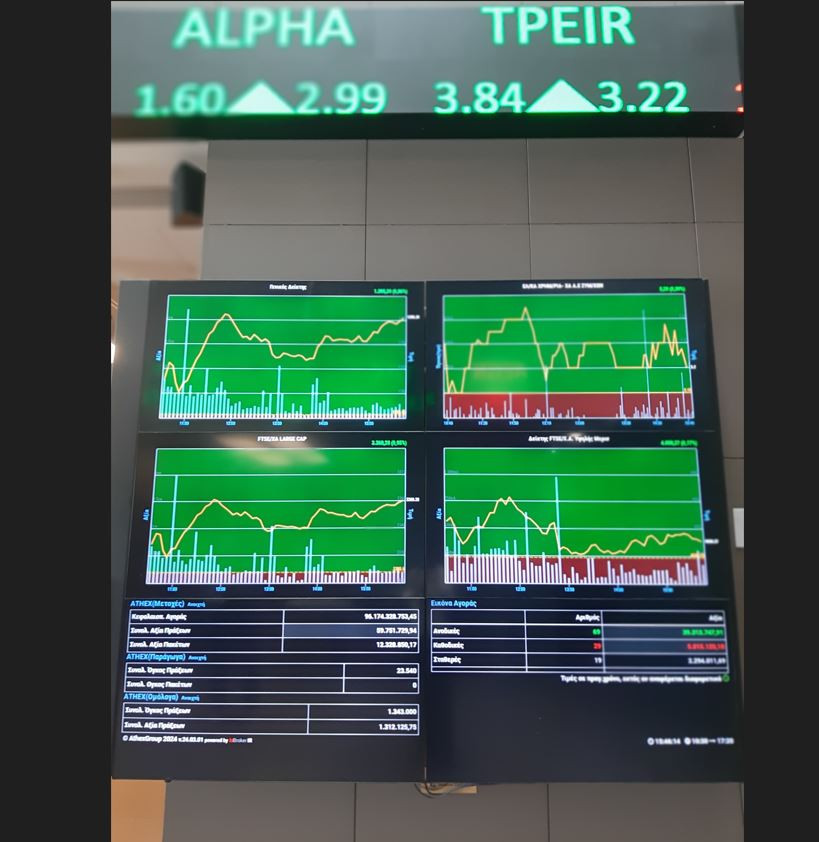

At changes in the regulation of the main market and to the benefits that the Greek stock market will have from its reclassification to the Developed Markets mentioned, among others, managing director of the Group, Yannos Kontopoulosin a presentation held, on Monday at noon, to representatives of the press at the building of A.A.

“The transition of the Athens Stock Exchange to developed markets is an important milestone for us, because it will enable listed companies to achieve better valuations, expand our access to the international investment community, increase liquidity and reduce the volatility of our market . We consider it appropriate over time to operate in an environment in which the best international markets participate, which broadens the visibility of our Stock Exchange and favors the continuous improvement of its characteristics“, he said characteristically in Skai.gro CEO of the Athens Stock Exchange, Yannos Kontopoulos.

For his part, speaking to skai.gr, the CFO of the Athens Stock Exchange, Nikos Koscoletos emphasized that “the introduction of Athens International Airport to the Stock Exchange has created a positive momentum. Provided that no exogenous factors arise capable of overturning the current market dynamics, we are optimistic that 2024 will close with more imports than last year, both in our Main and Alternative markets».

What is the process of switching to Developed Markets?

As explained by the managing director of the Athens Stock Exchange, the process of moving to the Developed Markets includes: The fulfillment of qualitative and quantitative criteria, the announcement of inclusion in the ‘watch list’ and the announcement of the date of final inclusion.

He noted that it will take approximately 1.5-2 years to achieve the upgrade, while the goal is to avoid frequent transitions between categories as well as to ensure smoothness and low adjustment costs for investors.

What is expected to happen on the way to the move to Developed Markets?

Mr. Kontopoulos emphasized that the reclassification will not be done simultaneously by all rating agencies.

He said that the A.A. it will be considered both Developed and Emerging Market by portions of investors. He emphasized that the investors are not all placed together at the beginning or at the end of the process and that capital inflows over time are expected to be greater than the outflows activated during the transition.

The Technical and Regulatory Improvements on the way to the upgrade will be:

- Improving the depth and liquidity of the market, reducing costs and more efficient use of the resources of the Members of A.A.

- The improvement of the technical infrastructure of the A.A. with the aim of reducing transaction response time (latency)

- The change in the risk calculation system of trade clearing (ATHEXClear)

It was noted that the participation of foreign investors in the capitalization of the AXA in the first quarter of 2024 reached 65.6%, while the participation in trading activity reached 55.7%.

Average Investor Active Shares were 26,409 in Q1 2024, representing a 5.3% increase over the same period in 2023.

Changes to the Regulation of the Main Market

Referring to the changes coming to the regulation of the main market, the managing director of the Athens Stock Exchange group emphasized that the objectives are:

- Strengthening the prestige of the Main Market

- Attracting new companies for listing on the Athens Stock Exchange

- The strengthening of trading activity

- Creating a more attractive investment profile for listed companies

Mr. Kontopoulos explained that the submission of the proposal to the Capital Market Commission took place in September 2023 and that the formal approval of the final text is expected in the following days, as well as the formal approval of the final text by administrative bodies of the Capital Market Commission.

From her side, Smaragda Rigakou, Legal Advisor to the Management, Director of Legal, Regulatory Services and Regulatory Compliance of the Athens Stock Exchangeunderlined at Skai.gr how “with the new Regulation, for the first time it will not be at the discretion of the Exchange to apply the market protection measures to a company due to insufficient dispersion, but it will be his obligation under the new clear provisions.’

Admission Requirements

The CEO of the Athens Stock Exchange also referred to the conditions for admission to the stock exchange.

Initial Dispersion

As he pointed out, it is determined in at least €200 million the capitalization which a company must have as a minimum to be eligible to list with less than 25% dispersionwhich however it cannot be less than 15%.

Profitability

The quantitative criterion of profitability is abolished.

Capitalization

New entry criteria: minimum capitalization €40 million to ensure the listing of companies of sufficient size on the Main Market.

Tax audit

The required tax certificate is abolished. Therefore, red tape is reduced.

Checking Dispersion Adequacy on a Continuous Basis

Dispersion will be considered sufficient when:

- It is at least 25% for capitalized companies < €200 million

- It is at least 15% for capitalized companies > €200 million

It is noted that the above does not apply if the company’s stock is traded in the High Trading Activity category.

Mr. Kontopoulos pointed out that adequate dispersion will be checked 2 times a year (ie every January and July) while in case of insufficient dispersion it will be provided period of 6+6 months for rehabilitation.

Surveillance Category

The non-observance of sufficient dispersion on a continuous basis by the listed companies is added as a new criterion for inclusion in the Surveillance Category.

At the same time, the time a company stays in the Surveillance Category is limited to 2 years.

Suspension of Trading

The time a share remains in suspension status is limited to one year.

The Stock Exchange will be able to suspend the trading of a share, and in the following cases:

- when stocks remain at Surveillance Category for > 2 years

- when the a stock’s spread remains <10% after the expiry of the deadlines set by the Regulation (6+6 months) to restore its dispersion

- when the company does not respond to a query of the Stock Exchange within the set deadline or when the Stock Exchange considers that the relevant response is not complete, sufficient or substantiated

Deletion of Financial Instruments

- There will be a possibility of deletion after the end of 6 months in Suspension, as opposed to the 18 months provided by the existing Regulation. Also, it is given possibility of extending the 6-month period for another six monthsupon reasoned request of the publisher.

- In addition, there will be a delisting of companies whose shares have been suspended because the dispersion is < 10% and

- ability of the Stock Exchange to transfer the shares of a company from the Main Market to Multilateral Negotiating Mechanism.

New Trading Category for Professional Investors

In the new Trading category for Professional Investors, trading will be allowed only by professional investors and private customers and for minimum investment amount of €100,000.

The aim, as pointed out, is to facilitate the introduction of new financial instruments (such as Eurobonds).

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.