The Company is firmly on the path of internationalization and development – Large industrial investments and the expansion in RES continue

THE METLEN announced the Financial Results of the 1st half of 2024.

Turnover was €2,482 million, compared to €2,516 million in the first half of 2023, despite a significant reduction in electricity and natural gas prices throughout the semester.

€474 million Earnings before Taxes, Interest and Depreciation (EBITDA), against €437 million in the corresponding period of the previous year, with a parallel increase in the operating margin by 169 basis points.

€282 million Net Profit After Minority Rights compared to €268 million in the first half of 2023. Accordingly, earnings per share amounted to €2.04 compared to €1.94 in the corresponding period of the previous year.

Net borrowing on an adjusted basis was €1,774 million, excluding non-resource borrowing. Despite an intensive investment program that is in full swing, adjusted Net Debt/EBITDA stood at 1.76x, in line with or better than the performance of investment grade companies. According to FITCH and S&P ratings, the Company is one step away from achieving the goal of achieving investment grade, for the first time in its history.

Commenting on the financial results, the President and CEO of the Company, Evangelos Mytileneos stated:

“The strong financial performance in the first half of 2024 confirms the consolidation of METLEN in the historically high levels of sizes it has achieved since the corporate transformation of 2022.

In a year with intense challenges, in an environment of high interest rates and intense geopolitical instability, METLEN’s business model, which has at its core the important synergies brought about by the coexistence of the Energy and Metals Sectors, demonstrates once again resilience and allows us to be optimistic about achieving the ambitious business goals we have set for the whole year.”

1. BASIC FINANCIAL QUANTITIES

Turnover amounted to €2,482 million compared to €2,516 million in the first half of 2023, marking a decrease of 1%, despite the significant de-escalation of energy prices, specifically both electricity (DAM: -54%) and prices of natural gas (-33%).

Earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 8% to €474m compared to €437m in the corresponding period of the previous year, benefiting from both the consistently strong performance of the Metals Sector and the continued upward course of the profitability of the Energy Sector and specifically the activity of Renewable Energy Sources (RES), which contributed approximately 1/3 of the Company’s total EBITDA. At the same time, METLEN succeeded in strengthening its profit margin, which in terms of EBITDA increased from ~17% in the first half of 2023 to ~19% in the first half of 2024. This was mainly the result of the greater contribution to mix of the Company’s profitability, Sectors with particularly qualitative characteristics such as RES, Metallurgy and Greek Utility.

METLEN once again achieved its historically highest performance in the first half of the year led by the Energy Sector. In particular, in addition to the significant contribution of M Renewables (RES of Greece and abroad), which saw its profitability increase significantly (+61%) compared to the first half of 2023, the Energy Sector also benefited from the substantial strengthening of the Hellenic Utility, which, in terms of market share, approached 20% at the end of the first half of 2024, both in the production and supply of electricity.

The Metals Sector, in the first half of 2024, surpassed the historically high levels of profitability of the first half of 2023, as a result of both the strengthening of aluminum premia and the API price of Alumina. The record six-month performance for the Metals Sector is mainly due to the timely action taken by the Company’s Management regarding both securing favorable LME prices, making the most of the opportunities given to it in the previous period, as well as the strict cost control.

The latter, after the end of the contract with PPC and the full takeover of the electricity supply of the aluminum plant by Protergia, is a key axis of strengthening the profitability of the Metals Sector in 2024 compared to 2023. The above, in combination with the , of pivotal importance, synergies offered by the coexistence of the Energy and Metals Sectors keep METLEN among the most competitive aluminum and alumina producers worldwide.

Finally, the increase in Net Profits, After Taxes and Minority Rights, which amounted to €282 million, increased by 5% compared to €268 million in the corresponding half of 2023, was particularly important.

Following the seasonality of recent years, METLEN’s financial performance is expected to strengthen even more in the 2nd half of 2024, led by the Energy Sector. The above will result in new, significantly higher levels of profitability, while the positive financial flows allow the realization of all these investments and the further strengthening of turnover with absolute control over key leverage ratios.

With reference to the activity of constructions and concessions, the Earnings before Taxes, Interest and Depreciation (EBITDA) amounted to €12.2 million compared to €7 million in the corresponding period of the previous year, with the prospect of a significant increase in the 2nd half of 2024, as the backlog of infrastructure projects in progress exceeds €800 million, while including projects that are at an advanced stage of imminent contracting, exceeds €1.2 billion.

The prospects of the construction sector in Greece are particularly positive, both for public and private projects, as well as for concessions and Public & Private Partnerships (PPP) projects, in which the Infrastructure Sector (METKA ATE and M Concessions) aspires to play a leading role roll.

2. UPDATE ON THE OPERATION OF THE BUSINESS BRANCHES:

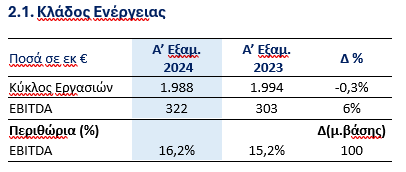

The Energy Sector recorded a turnover of €1,988 million, which corresponds to 80% of the total turnover, remaining at the same levels compared to the first half of 2023. Earnings before Taxes, Interest and Depreciation (EBITDA), amounted to €322 million increased by 6% compared to €303 million in the first half of 2023.

METLEN Energy & Metals, through its new structure, has acquired an even more dynamic and flexible form, able to face the challenges that are taking shape, as well as those that will arise in the future. At the same time, the Company is strategically positioned at the forefront of the energy transition as a leading and integrated energy company, with an international presence in the entire spectrum of energy (Renewables, Energy & Generation Management, Energy Customer Solutions, Integrated Supply & Trading and Power Projects).

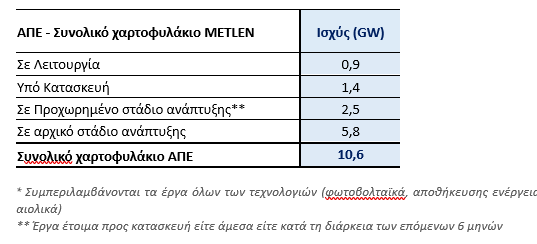

The total capacity of M Renewables’ mature and operational global portfolio, dynamically expanding across five continents, amounts to ~4.8 GW, while including a series of projects in early and mid-stage development, with a capacity of approximately ~5.8 GW, the METLEN’s global portfolio at the end of the first half of 2024 now stands at 10.6 GW.

Energy production from Renewable Sources units, with a total installed capacity of 0.9GW at the end of the 1st half of 2024, amounted to 632 GWhs. Of these, 327 GWhs were produced by RES in Greece and the remaining 305 GWhs by RES abroad.

METLEN, effectively continuing the Asset Rotation Model, proceeded within the first half of the year to an agreement of strategic importance with PPC, which concerns the disposal of projects with a total capacity of ~2GW in Europe and more specifically in Italy (503MW), Romania ( 516MW), Croatia (445MW) and Bulgaria (500MW) with an implementation horizon of 3 years.

The successful Asset Rotation Model allows the Company to seamlessly continue to grow the profitability of M Renewables, while at the same time making proper use of all available financing tools. As a result of the above, the Company has a self-financed RES development model, while maintaining low levels of leverage and an excellent credit profile.

Through the Asset Rotation Model, the signing of agreements for the sale of photovoltaic (PV) projects (SPAs) with a total capacity of ~531MW in Europe was also completed within the first half of 2024.

With reference to METLEN’s portfolio of own projects that are being developed in Greece, work continues normally to complete the construction of ~340MW, while within the second semester, the start of construction for an additional 550MW is expected. This portfolio draws on resources from the Stability and Recovery Facility (RRF).

Regarding the international portfolio, METLEN is currently constructing over 1 GW of PV projects, which are expected to be commissioned in the next period.

In the context of the Global Energy Transition, through the shift to RES, as well as the Sustainable Development Strategy adopted by the Company in recent years, METLEN proceeded, in May 2024, to sign two 10-year PPAs with Keppel DC REIT for the supply of energy at Keppel DC REIT’s two facilities in Dublin, which will be generated from two PV parks in Ireland. Through them, “green” energy will be provided, reducing carbon dioxide emissions by 6,250 tons of CO2 per year.

With regard to projects for third parties, the execution of projects continues without problems in countries such as Spain, the United Kingdom, Greece, Italy, Romania, with the contracted balance (signed backlog) standing at €221 million, while an additional €360 million is in the final phase of negotiation.

Greek Market Data – H1 2024

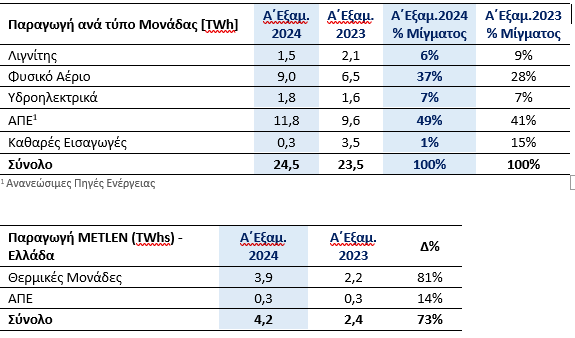

The first half of 2024 was characterized by the significant strengthening of electricity demand, with the increase being of the order of 4% compared to the first half of 2023. The largest increase, compared to the corresponding period of 2023, was noted by production from natural gas thermal units, which increased by almost 40%, while RES followed with an increase of 23% compared to the corresponding period of 2023. In contrast, lignite production decreased by 30%, while energy imports from third countries almost zeroed out (~1%), from the level of 15% of demand in H1 2023.

In more detail, the three combined cycle plants (CCGTs) and one high-efficiency cogeneration electricity-heat plant (CHP) produced in the first half of the year, a cumulative 3.9 TWh from 2.2 TWh in the corresponding period of 2023, a increase of METLEN’s thermal production by about 80%. This amount represents 43.4% of production from natural gas plants, up from ~33% in 2023.

The significant increase in production from thermal units in the 1st half of 2024 compared to the corresponding half of 2023, is mainly due (despite the scheduled maintenance that took place in April) to the (albeit still experimental after being 50 days out) operation of the new CCGT plant (826 MW). Therefore, and due to the very strong demand, especially in the 3rd quarter of the year, the production of the 2nd half is expected to be significantly strengthened. The new CCGT unit contributes decisively to supporting the country’s transition towards an energy mix with a significantly smaller carbon footprint. The above, combined with the high degree of efficiency and flexibility of our units and the supply of natural gas (NG) at competitive prices, are expected to significantly boost the profitability of the second half and by extension 2024.

The company’s total production in Greece, both from the company’s thermal and renewable units, amounted to 4.2 TWh, a quantity corresponding to 17.3% of the total demand, from 10.4% at the end of A ‘ half of 2023. METLEN, in the last year has managed to almost double its production and therefore its market share, which both due to the increase in production from RES and due to the full inclusion of the new CCGT unit (826 MW) , is expected to continue its upward trend in the coming years.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.