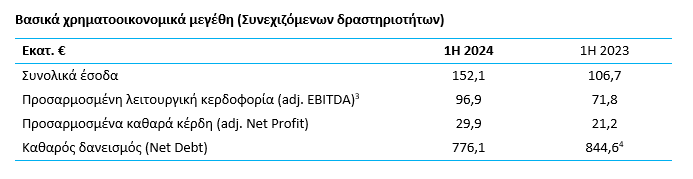

In the first half of the year, TERNA Energy’s revenues reached 152.1 million and the adjusted net profit reached 29.9 million. At 1,224 MW, the installed capacity

Revenue (+42.5%) and net profit (+41.0%) from continuing activities of TERNA Energy showed a significant increase during the first half of the year, following increased installed capacity and more favorable wind conditions, compared to corresponding period of the previous year. The net loan position as of 30.06.2024 amounted to € 776.1 million (not including an amount of € 43.6 million related to activities for sale) compared to € 844.6 million at the end of 2023.

As stated in a related announcement, the installed capacity at the end of the 1st Semester amounted to 1,224 MW compared to 1,096 MW at the end of the first half of 2023. It is recalled that the 327 MW Kafirea project was fully electrified in the last quarter of 2023. Since the beginning of the year, TERNA ENERGY Group has continued the further development of its portfolio, as 63 MW of photovoltaics are under construction in Greece, while the construction of another 550 MW of new projects of various technologies (mainly PV but also wind and storage projects) is gradually starting in Greece and abroad, which are expected to be put into operation by the end of 2025, representing a total investment of €370 million. At the same time, the construction of the Amfilochia pumped storage project is progressing according to plan.

Regarding the load factor, it was 30.3% for the entire portfolio, compared to 27.6% for the first half of 2023, while specifically for Greece it was 30.5% compared to 27.6 %. Combined with increased installed capacity, energy production increased by 45.4% to 1,575 GWh. It is noted that excluding the Kafirea project, energy production increased by 10.7%.

The total revenue from continuing operations during the first half of 2024 amounted to € 152.1 million compared to € 106.7 million in the first half of 2023, following the increase in energy production and sales, showing an increase of 42.5% .

In terms of profitability, the adjusted operating profitability (adjusted EBITDA) from continuing operations amounted to € 96.9 million compared to € 71.8 million in the corresponding period of the previous year, following higher sales, representing an increase of 35.0%.

The net financial expenses from continuing activities for the first half of the year amounted to € 29.6 million compared to € 21.6 million in the corresponding period of 2023, following mainly the increased borrowing due to the implementation of new investments.

Earnings before taxes from continuing operations amounted to € 40.3 million, increased by 49.9% compared to € 26.8 million in the corresponding six-month period of the previous year. The net profits of use from continuing activities attributable to owners of the parent company amounted to € 29.9 million, increased by 46.3% compared to the corresponding six-month period of the previous year (€ 20.4 million).

The Group’s operating cash flows from continuing activities for the 1st Half of the year amounted to €85.8 million, compared to €65.2 million in the previous year, following improved operating profitability. As regards the investment costs for ongoing activities (Capex), these amounted to € 42.0 million for the first half of the year and are expected to increase in the following periods, as a result of the implementation of the investment plan.

OR net borrowing position (loan liabilities minus cash, minus restricted deposits related to loan liabilities) was formed at the end of the 1st Half of the year at the level of € 776.1 million (not including an amount of € 43.6 million related to activities and assets to sale) for €844.6 million at the end of 2023.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.