Actors, investors and businessmen who found themselves at the absolute “bottom”…

Having money is not always a guarantee of continued financial success. Although Benjamin Franklin argued that “money brings money”and while it is true that a greater range of possibilities is open to those with capital, the rich are also capable of making bad decisions.

Actors, investors, heirs – as the list below proves – no one is safe when greed, malice or overconfidence knock on the door. Simply put, they experienced the ultimate financial disasterbut some managed to get back on their feet.

-

Nicolas Puech Hermes

Nicolas Puech Hermes first became famous in mid-2023 when it was announced that the French octogenarian, one of the heirs of the luxury house Hermes, wanted to adopt his gardener. Its intention was to make it easier for the employee to inherit his property, which is valued at 13.4 billion dollars.

This magnanimous gesture to his staff, however, remained just that: a gesture. In July, Puech’s lawyers revealed to a Swiss court that he no longer owned the Hermes shares. According to a court order, for 24 years, Puech employed a financial manager named Eric Freymond. In 1998, he gave Freymond authority over his accounts.

🇨🇭🇫🇷 FLASH | Le Français Nicolas Puech, installed en #Suisse depuis plus de 20 ans, héritier de la marque de luxe #Hermèscélibataire et sans enfant, souhaite adopter son homme à tout faire, un #Marocain aged 51, in order to give him half of his estimated fortune at 10… pic.twitter.com/fxcO0ueJhw

— Cerfia (@CerfiaFR) December 4, 2023

In 2022, the heir overturned this order, seeking to take back control of his finances in order to bequeath them to others. A year later, he sued Freymond, alleging that the financial manager withheld information and did not return the shares. The court ruled against the heir, on the grounds that he had voluntarily given the administrator free rein to control his accounts and had not properly supervised their management.

-

Bill Hwang

Although his name is little-known outside financial circles, Bill Hwang became famous in 2021. He arrived in United States as a young boy from South Korea and started his career in finance in 1996. In 2001, he started his own hedge fund, Tiger Asia Management. In 2012, the Securities and Exchange Commission in Hong Kong found evidence that the company engaged in insider trading and price manipulation, forcing it to shut down. The following year, Hwang opened a family office called Archegos Capital Management.

Under looser supervision and the complicity of big banks like Credit Suisse and Nomura, the new company was allowed to operate in an even more suspicious manner. At its peak, it managed $75 billion in assets and loans. In March 2021, the company did not survive, leaving losses of nearly $4 billion. In 2022, US federal prosecutors filed 11 charges against Hwang, including falsifying information to banks to obtain financing. Last July, a jury found him guilty of 10 of those charges.

-

Pamela Anderson

Pamela became famous for her role in ‘Baywatch’ but ended up living in a trailer park. Of course, hers was no ordinary trailer park – it was a luxury complex frequented by celebrities.

It was 2009, almost 20 years after Anderson became famous. Her career had been profoundly affected by the leaking of a sex-tape that had been stolen from her home. Renovations to her Malibu mansion were running over budget and over schedule.

According to the Daily Mail, at the end of October of that year, Anderson had about $3,000 in the bank and was $636,000 away from completing her home renovation. To her credit, the actress eventually managed to recover. She left the park, paid off her debts and sold the trailer. Today, she has settled in Canada, in the house she inherited from her grandmother.

-

Sam Bankman-Fried

Sam Bankman-Fried, who in his heyday was considered one of the child prodigies of crypto, founded Alameda Research in October 2017. Apart from Mark Zuckerberg, no one else has become so rich at such a young age. At the age of 29, Sam Bankman-Fried made his debut on the Forbes list of the world’s 400 richest people.

As with many of today’s cronies, Bankman-Fried made his fortune in the cryptocurrency market. The paradox is that he has never been a big supporter of bitcoin. FTX soon became the second largest cryptocurrency platform in the world, becoming worth over $32 billion.

The collapse began when Alameda took out loans that it placed in illiquid investments. Unable to repay these loans, Bankman-Fried used money deposited with FTX to bail out Alameda. Eventually, these bad practices caught up with him, leading to the collapse of FTX. In November 2022, FTX filed for bankruptcy. Bankman-Fried was arrested in December of that year. In March 2024, after being found guilty, he was sentenced to 25 years in prison.

-

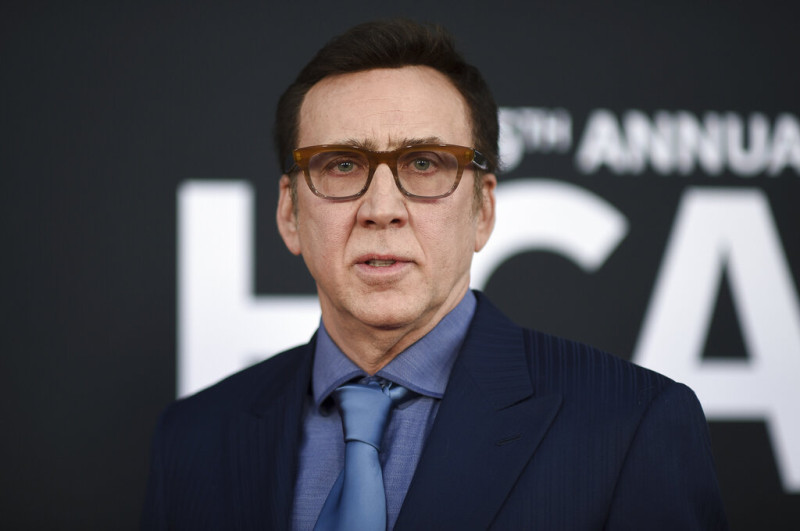

Nicolas Cage

The famous actor, Nicolas Cagewent through a period of severe financial distress, although it now appears to have recovered. In an interview with CBS News in April 2023, Cage confirmed that he was $6 million in debt after the housing market crash.

“I had invested too much in real estate. The market crashed and I couldn’t get out in time. I paid them [τους πιστωτές μου]everything, but it was about $6 million. I never filed for bankruptcy,” the actor said.

The key to Cage’s comeback was work. His film appearances at the time were the subject of mockery on the internet, but the actor never regretted it.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.