The new requests of debtors in the extrajudicial mechanism amounted to 5,522 and a total of 1,504 new arrangements were made for debts of more than 383 million euros

Both new applications and debt settlements through the out-of-court debt settlement mechanism recorded a significant increase in September compared to the same month of 2023.

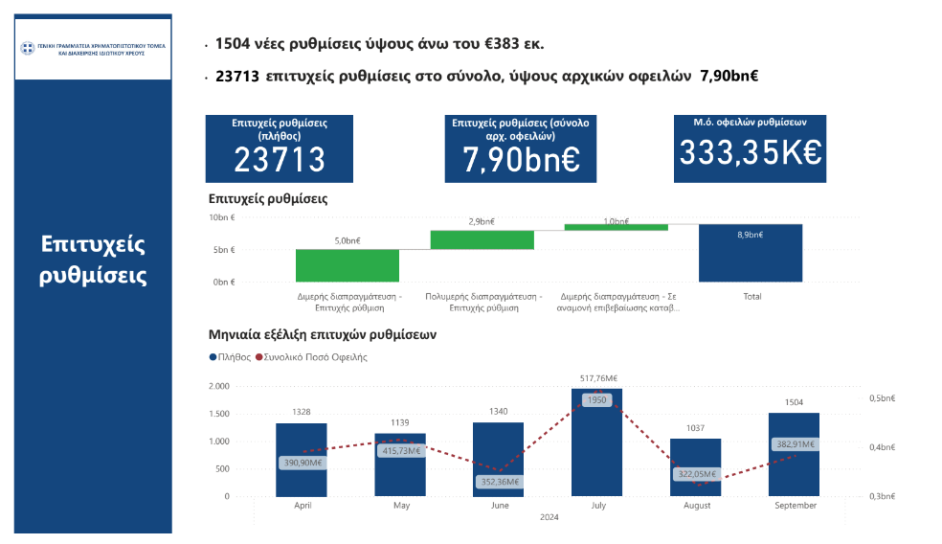

More specifically, the new requests of debtors in the extrajudicial mechanism amounted to 5,522 and a total of 1,504 new arrangements were made for debts of more than 383 million euros. It’s about 52.2% increase in new applications from 3,628 in September 2023 and 75.7% in new debt arrangements compared to 856 in the same period last year.

They are recorded in total 23,713 successful settings for initial debts amounting to €7.9 billion settled through the out-of-court mechanism by the end of September, significantly increased from the 8,804 successful initial debt settlements of €3.26 billion by the end of September 2023.

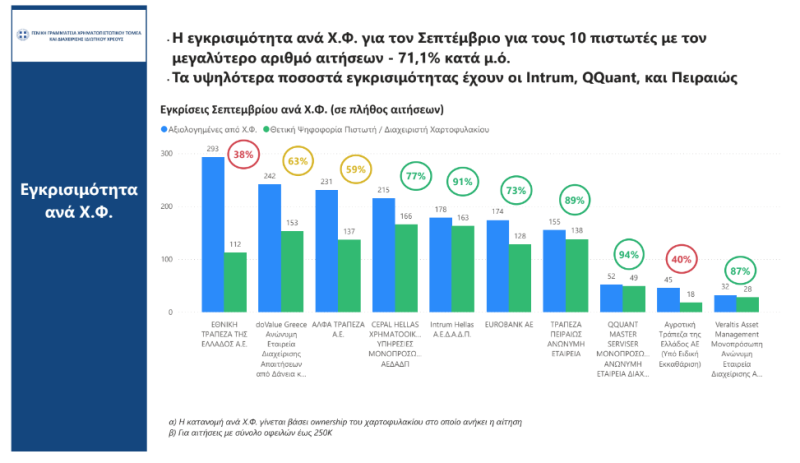

It is noted that 47.3% of the settings to financial institutions received a haircut, based on debts, that exceeds 30% with the total amount of the write-off amounting to 2.43 billion euros. In high rate of 71.1% on average, the approval of applications by financial institutions varies.

At the same time, data is published on the bilateral arrangements made in the month of August, amounting to 150 million euros for 2,608 debtors and corresponding to the largest loan management companies. The small decrease in these indicators is due to the fact that during the month of August the flow of procedures for the involved parties is suspended.

OR positive course of private debt in the banking sector is also reflected in the latest official data published by the Bank of Greece according to which the non-performing loans of Greek banks (on an individual basis) during the second quarter of 2024 decreased to 10.43 billion euros from 11.10 billion euros in the first quarter.

In addition, the same figures show a decline in the ratio of non-performing loans in Greek banks, closing the second quarter of 2024 at 6.9% from 7.5% in the first quarter. It is noted that non-performing loans in the entire financial sector (Banks and Servicers) have shown a noticeable decline in the last 5-years, since from 92.2 billion euros in 2019 to 69.9 billion euros in June 2024.

It is recalled that, with the aim of making more effective use of the available debt settlement tools, the General Secretariat of the Financial Sector and Private Debt Management provides nationwide service by video call or by telephone by appointment through the platform (https://www.gov.gr/ipiresies/polites- kai-kathemerinoteta/ex-apostaseos-exuperetese-politon/exuperetese-me-telediaskepse-kai-telephonike-epikoinonia-apo-ten-eidike-grammateia-diakheirises-idiotikou-khreous-egdikh) or by phone at 213.212.5730.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.