The varied and varied professional activity of K. Piladaki – From video clubs to airwaves and from CDs to bets

Faced with perhaps the biggest challenge of his varied and diverse professional and personal life, the commitment of his property, is the Kostas Piladakis, the man that many describe as… “survivor” (perhaps the designation also fits because he is related to the actress-model Nausika Panagiotakopoulou who played in the game). For some others, again, it is “the man who started from scratch and was given nothing.” What is certain is that the business path of Kostas Piladakis has many ups and downs but also many stops: from video clubs, airlines, record stores, real estate, casinos to the round goddess…

From the video club to the airwaves

He was born in 1966 in Athens, and at the age of only 20 he started a videocassette business, realizing that video clubs would rise to the “zenith”. It is even said that he himself had undertaken the distribution of the video cassettes on a scooter in Filothei. The neighborhood video club, which is doing golden business, however, is not what he has dreamed of.

Thus, at the beginning of the 90’s he entered the aviation sector, participating in the founding of GSA, (he represented companies such as American Airlines, Luxair, China Airlines and Air Afrique in Greece). Among them the newly established Virgin Atlantic company of the well-known Sir Richard Branson. In 1992, Piladakis together with another partner took the next… aviation step. They found South East European Airlines. The company’s first routes were within the country, while a little later chartered flights to European destinations also started. It was November 1992 when the contracts were signed with the British Virgin Atlantic for the route Athens – London – Athens. South East European Airlines came to employ 350 people. Unfortunately, however, it did not have the path Piladakis dreamed of. In just three years of operation, the financial problems that arise are insurmountable, and at Christmas 1993, it is closed, with the then 27-year-old Piladakis facing debts of hundreds of millions.

…and from the airwaves to records and CDs

1996. Almost three years have passed since the airline lockout and Piladakis is starting the next venture. It gets the green light from Sir Richard Branson, who at the time developed the music department stores Virgin Megastores and is preparing the expansion of the British brand in Greece. Through the Vivere Entertainment company, in which Marfin acquired a 15% stake at the time, Marfin opened the first Virgin Megastores record store in Stadiou. The experience from the video club and the contribution of Branson’s know-how, make this first store a point of reference. 13 more stores are opened in Greece and Cyprus and in 2002 the company crosses the threshold of the Athens Stock Exchange through a merger with Agrinio Metallurgy.

The music industry, however, is starting to take the first hits. Within five years record sales are cut in half and record stores begin to close one after another. Records and CDs are starting to fall into disrepair as people turn to online record stores, the internet, and mp3s.

Ten years after the opening of Virgin Megastores in Stadiou, Vivere Entertainment shows a loss of 6.2 million on its balance sheet. euros, a 26% drop in its sales and high liabilities.

Place your bets please…

Piladakis does not hesitate. It finds an outlet in a different field of activity. That of casinos. After all, he has already started to gain relevant experience, since since 2002 he has become a key shareholder of the Rio Casino. Thus, after the fall of Virgin Megastores, he merged Vivere Entertainment with Casino Thrace in which at that time the Hatziioannou brothers participated (they owned the holding company of the same name, while they also owned the Sprider company) and Kanellakis (shareholders at that time of PAE) Ionian and owners of the beverage companies NEKTAR SA and NK Liqueur Stores).

Its aim is to create a strong pole in the gambling market. Thus, it also acquires the Casinos of Corfu and Thrace.

In fact, publications of the time bring Kostas Piladakis to open a casino in 2012 in Zambia, in the capital Lusaka, where there is a thriving strong Greek community, on the occasion of a concert by his close friend and best man Antonis Remos on the African continent.

In these bets of Piladakis, it seems that the bank had the advantage, with the result – as he himself will declare many years later – that he lost his property.

In September 2013, he sent an out-of-court letter to the employees of the Xanthi casino, informing them of his decision to close the business. The problems at all three Piladakis casinos have since become a mountain. Operating license suspensions, lockouts mainly due to the non-fulfillment of financial obligations to the State and the insurance funds, but also to the employees.

The huge financial obligations that have accumulated are a difficult obstacle to overcome, which also includes a barrage of judgments, confiscations and auctions of his personal properties.

“I lost my fortune and casino business”

Last July, Piladakis, in a statement-response to the Federation of Gambling Employees’ Associations, states among other things: “Everyone knows that I am permanently leaving the casinos and I have already submitted an application to the EEEP for the transfer of my shares, which are pledged in favor of the lenders, to the New Investors with whom I am not connected in any way. I formally remain in the representation of the casinos due to of the obligations that exist because no one accepts to undertake them until they are regulated with the provisions of the law on consolidation and the extrajudicial mechanism.

For 12 years, I was responsible for more than 120 redundant workers who for more than 8 years were paid with wages at least twice the legal wage, even though we had the right to limit them unilaterally, resulting in the swelling of obligations mainly to EFKA and all this in the economic crisis that destroyed businesses and our country itself. Over the years, these casinos have returned tens of millions of euros to the State and provided work and bread to almost 400 families. I lost my fortune and casino business.

The New Investors make all the decisions and have already contributed over 6,000,000 euros to the companies.

The casinos of Alexandroupolis and Corfu have entered a phase of consolidation and development.

Since I am now leaving for good, some people will have neither a role nor a reason and are trying to maintain the image of the “bad” Piladakis. They need an “enemy”. The “enemy” who has paid them rich salaries for almost 20 years!

However, even this does not give them the right to insult me in such a provocative way. Abusers will be held accountable.”

It is noted that the New Investors mentioned by Mr. Piladakis in his announcement is the British fund Glafka Capital, which has agreed with Intrum to buy bank loans amounting to 150 million. euros of the three casinos, while it has already submitted applications for their consolidation.

R&P Real Estate, by Remos and Piladakis

Among all the other activities, the real estate sector could not be missing. Christmas 2005 Piladakis and Remos founded R&P Real Estate Investments SA (derived from their initials). The company has made large investments in Glyfada and Vouliagmeni, but also in Mykonos.

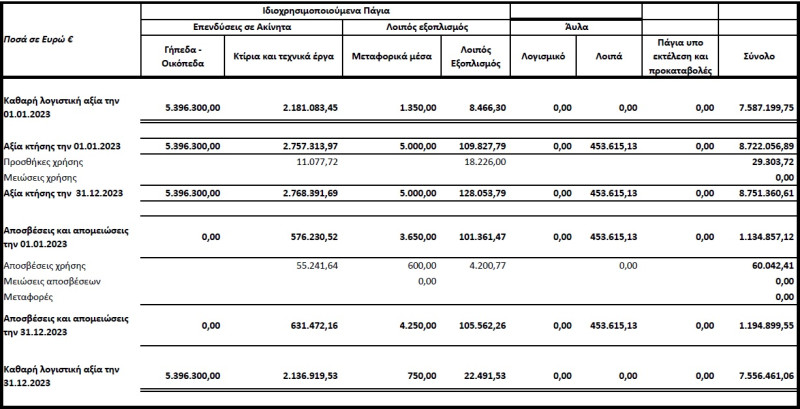

Even this activity, however, – as the goals show – was not crowned with success. Based on the latest published balance sheets, in terms of results, R&P Real Estate Investments (in which Kostas Piladakis appears as vice president and managing director), announced losses of 1.35 million. euros, while its debt, which is covered by collateral, amounts to 10,493,625.57 euros.

Football

In addition to his professional activities, Piladakis was also actively involved in the field of football. Initially as a factor of Piraikos, he continued in 2000 with the team of Ilysiakos. He also gained publicity as the owner of the Larissa Sports Union, in which he was president for nine years (2004–13), leaving for many a “legacy” the AEL FC Arena, the modern football stadium where the team plays in Neapolis Larissa. The construction of the stadium lasted about fourteen months, started in September 2009 and was completed in November 2010, but did not bring the expected profits, as a result of which the bankrupt AEL returned to the 4th National League.

Back in the limelight

The name of Mr. Piladaki came back into the limelight on the occasion of yesterday’s decision by the Anti-Money Laundering Authority, which proceeded to freeze his entire property, while the charges he faces are fraud, tax evasion and money laundering.

Responding to the Authority’s decision, Mr. Piladakis denied the accusations while stressing that “no one has called him to give an explanation”.

“No one has called me to give explanations for the baseless things mentioned in the reports. I will make a request, through my attorneys, to obtain copies and place them with the appropriate authorities. I believe that leaks in such cases do no honor to anyone,” he says characteristically and adds:

“Both myself and my companies of interest have been subjected to exhaustive tax audits from time to time and it has been amply demonstrated that there was not even a shadow of illegality. I have been in business for more than 3 decades. My companies and I have paid hundreds of millions of euros in taxes and insurance contributions to the Greek State. Until 2010 we did not owe anyone a single euro. Casino businesses found themselves in the throes of an unprecedented financial crisis. We managed to keep the businesses alive. I employed over 400 people. For more than 14 years, the companies employed at least 210 redundant workers. This and the heavy taxation, combined with the collapse of revenues, led the companies to owe large sums mainly to the insurance organizations. We made enormous efforts to meet the obligations. I personally mortgaged or even sold all my property to support businesses and avoid laying off so many people. I suffered hardships and even a loss from the Greek State which for years did not return to my company the VAT due, which we finally assigned and the State collected. Even to this day, the State owes me millions of euros, for which I have appealed to the Court and I have won in the first and second instance the appeals. This delay has caused me incalculable damage both personally and to my companies.

I do not accept accusations of alleged money laundering or tax evasion circulating in all news channels and media. Everything was done and is done legally. I understand that the coordinated State does and must do checks.

The control and research, however, do not constitute proof of what is being researched. I was, am and will always be at the disposal of the authorities for any inspection and any explanation, and I am sure that the truth will shine forth.”

Personal life

However, K.’s personal life has also been in the spotlight. Piladaki who has had two marriages. From the first, he had a son, Manos (b. 1997), with the fashion designer Sofi Deloudis. From the second (2004-2011), with the actress-presenter Doretta Papadimitriou, he had two more sons, Dionysis (born 2004) and Filippos (born 2006).

From 2011 to 2018 he was in a relationship with singer Irini Papadopoulou. Since 2020 he is in a relationship with Nausika Panagiotakopoulou.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.