The Health Care Group is the largest in the Middle East and North Africa, with 25 hospitals, more than 100 clinics and 160 laboratories

Its entry into the Greek market is made by Abu Dhabi’s Purehealth Holding Pjsc, which acquired a majority package in Greek hospitals from the CVC. With this move, the Emirates’ efforts to produce 50% of his revenue outside the Gulf Cooperation Council, according to CEO Shaista Asif said. (The Cooperation Council for the Arab Gulf states, initially known as the Gulf Cooperation Council, is a Regional Intergovernmental Policy and Economic Union consisting of all Arab states of the Persian Gulf, except Iraq) .

What is Pure Health Holding PJSC

This is the largest Middle East health care group based in Abu Dhabi. It has a multi -class ecosystem covering hospitals, clinics, diagnostics, fuses, pharmacies, research, healthcare technology and supplies and has a presence in the US and the United Kingdom.

According to Purehealth’s website, it is difficult to find a resident of the United Arab Emirates who has not visited or interact with the group associated with the group. Apart from the Middle East, it is also the largest in North Africa, with more than 25 hospitals, more than 100 clinics and 160 laboratories, and also offers health insurance providers, pharmacies, health technology companies, supplies and investment. “Having all these elements under an umbrella we are given the opportunity and flexibility to provide holistic care to our patients with the maximum positive impact on thisAs, “says Shaista Asif, co -founder and chief executive of the Purehealth Group, stressing that the team’s ultimate goal is to be able to achieve longevity for people, helping them live healthier for longer.

Him January 2022Purehealth’s shareholder, Alpha Dhabi Holding (Adh), announced that it had concluded an agreement with the ADQ State Fund to consolidate many companies within Purehealth.

The Group operates as a portfolio company for 61 subsidiaries covering six business sectors. Entities under its umbrella include Abu Dhabi’s Health Services Company, the National Health Insurance Company PJSC (Daman), the Abu Dhabi stem cell center, the Ambulatory Healthcare Services, the Rafed, the Yas Clinic Group, The Life Corner, Tamouh Healthcare, Medical Office, Pure Lab and One Health.

Entrance to the US market

The deal has led ADQ to become Purehealth’s largest shareholder, along with other interested parties, such as ADH, International Holding Company (IHC), AH Capital and Ataa Financial Investments. However, the makers were not enough to maintain the largest health care network in the region, so Purehealth began to extend abroad. “Our investment strategy is to grow in international markets, invest in companies that add value to our investment portfolio and our business skills as well“, Explains Asif.

Him September 2022Purehealth announced that it had entered into a definitive $ 500 million market agreement to obtain a minority participation in the Ardent Health Services (ARDENT), the fourth largest private provider of acute care hospitals in the US, with 30 hospitals, more than 200 care spaces in six states and about 26,000 workers. “Ardent was not a strange move for us because he is a high quality provider and market leader in the six states in which he operates“, Says Asif. Investing in the US market was also a strategic move. “We are very much rough to build relationships with top US healthcare companies, because the US market is known for its level of medical research and the provision of excellent health care services“

Target a long -term but functional life

According to Shaista Asif, investment outside the UAE serves a key Purehealth goal. “We are trying to make use of these partnerships to move forward even faster in the science of longevity and bring the next level of care to the UAE, where we will undoubtedly benefit from research and development“

“Life expectancy around the world is increasing and the number of ‘centuries’ is also increasing, but while there is a lot to celebrate, such as increased longevity, we believe it is just as important to discuss the improvement of health duration.“, Argues the Mona Hammamihead in the Middle East for the McKinsey Institute. “We have added 20 years in life since 1960, but we spend 10 of these extra years with moderate or poor health. To cover this gap, technology can play a critical role in prevention, early diagnosis of health challenges and enabling people to live independently and participate socially for many more years“

With a large and wide portfolio of health care providers under its zone in October 2022, Purehealth announced that it intends to increase the average life People in the UAE from 78 to 101 to 2071. The group intends to support each person in all his health care needs, including progressive controls, maternity and care examinations, oncology, emergency care, long -term care with stem cells. “We focus on adding years to your life and life in your years. We are on a trip to unlock the time“, Says Asif.

Iron Lady at Purehealth’s steering wheel, shaista Asif

Her own journey Shaista asif It started in this area more than 20 years ago. She began her career in 2001 in her country of origin, Pakistan, as a consultant before joining the local Mobilink Telecommunications Provider in 2003 in engineering as head of project management and climbed the steps as a business manager.

Three years later while still working for Mobilink, he was associated with Farhan Malikwho is now Purehealth’s chief executive. The couple decided to deal with businesses by choosing health care because of the opportunities they provided for modernization. They wanted to merge technology with healthcare functions to provide a competitive and effective service. “Healthcare and the way in which we were delivered were not optimal and we wanted to do something about it“, ASIF recalls.

In 2006, using personal savings, they founded Purehealth Medical Supplies in the UAE, focusing on the provision of diagnostic services. Next year, Asif resigned from her job at Mobilink to focus on her new startup. She also co -founded Utrade in 2008, focused on digitizing traditional trade, but left in 2013 by selling her share of the company.

By 2012, Purehealth Medical Supplies offered data -based solutions and began to increase its reputation as a technology factor in healthcare. At the beginning of 2020, the Ihc acquired 31.5% of the company. A year later, in March 2021, ADQ signed an agreement to merge the healthcare service sectors, Rafed and Union71, with Purehealth Medical Supplies, transferring the ownership of the two entities to the group and receiving a share in Purehealth in return. The merger was completed in October 2021, according to IHC. At the beginning of 2021, the ADH – IHC subsidiary – also acquired 31.5% of Purehealth Medical Supplies. And a few months later, IHC transferred Purehealth’s 31.5% share to ADH, increasing ADH’s equity to 63%. In January 2022, following the ADH and ADQ deal that made ADQ the largest shareholder of Purehealth, the company officially changed its name to Purehealth Group.

When was entered into the stock market

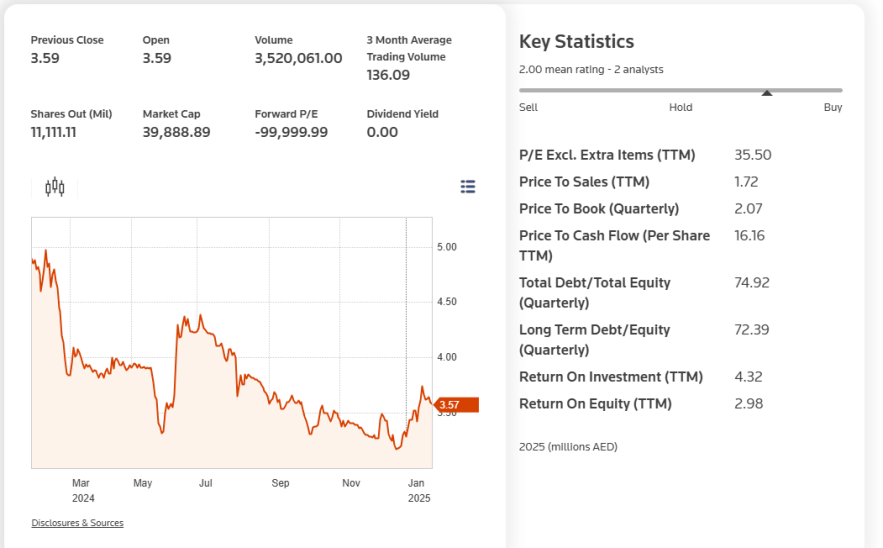

An important milestone for Purehealth was in December 2023, when it was introduced to the Abu Dhabi Stock Exchange.

The shares of the Abu Dhabi Purehealth Holding healthcare platform raised up to 69% above their importing price on their market debut, while the company raised nearly $ 1 billion in the original public bid (IPO) for 10%.

Purehealth has played a decisive role in controlling COVID-19 infections in the United Arab Emirates and its original public offering has been in the process for years. The shares reached 5.5 Dyrhham ($ 1.50/1.42 euros), while the price with which they made their entry into the brokerage dashboard after IPO was at 3.26 Dirarcham (0, 93 euros) per share.

Purehealth is owned by Abu Dhabi’s state -owned Adq Fund and one of the largest groups in the capital, IHC (International Holding Company), chaired by Sheikh Tahnoun Bin Zayed Al Nahyan, National Security Advisor and Brother of the President of the UAE, Sheikh Mohammed bin Zaed.

The acquisition of Hellenic Healthcare Group

As far as Hellenic Healthcare Group is concerned, it is the largest private health service group in Greece.

Founded in 2018 with the aim of starring in the continued development of medical and nursing care, a market that presents significant opportunities and prospects in Greece.

THE HHG Groupthe largest Group of Health Services in Greece, has 9 top clinics: Health, Metropolitan Hospital, Mother, Metropolitan General, Leto, Creta Interclinic in Crete, City Hospital in Kalamata, Apollonio Private Hospital and Aretaio in Cyprus. It also has advanced Healthspot, Platon Diagnosis, Prognosis and Democritus diagnostic centers, Homecare Home Health Services, Molecular Biology and A-Lab Genomics Center, A-Labs, GMP Assistant Health Unit, Trading of Medical Products, Business Care with employment and health and health services in business and organizations and the Heal Academy Educational Center for training, training, training and research on medical, nursing and all health sciences.

HHG has used CVC Capital Partners investment funds, one of the largest private capital investment organizations worldwide, with a presence in 29 countries.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.