S&P 500 scored its third best daily performance after World War II, Nasdaq the second best in its history – Rally for oil – 7% jump for bitcoin

US President Donald Trump’s decision to “freeze” for 90 days, with immediate effect, the imposition of “mutual” duties on countries approaching the US for negotiations of trade agreements and did not retaliate, and instead of the same period, at the same time, a 10%horizon Investors and launched Wall Street indicators.

The US market started the meeting uphill but cautiously, but after the Trump decision it has served on a stunning sprint, with indicators recording their best performance for several years.

In particular, the industrial index Dow Jones He made a jump of nearly 3,000 points (2,962.86 points for accuracy or 7.87% and closed at 40,608.45 points, scoring his biggest daily rise since March 2020.

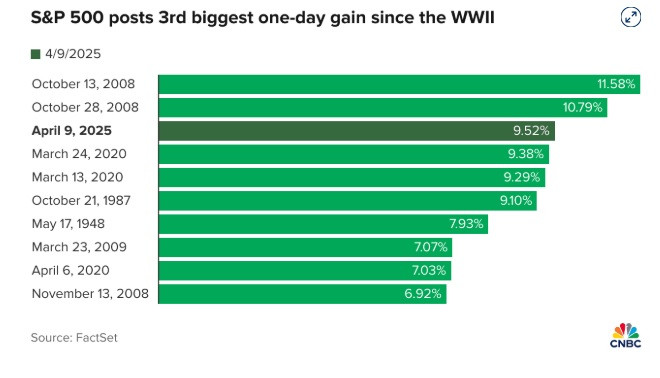

The wider S&P 500 It launched 9.35% higher and finished at 5,448.50 points, achieving its best daily performance since 2008 and its third best performance after World War II.

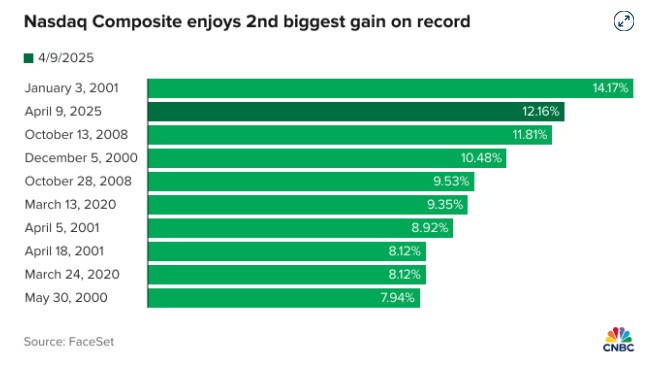

Even more spectacular was the rally of the techno Nasdaqwhich with a stunning +12.16% closed at 17,124.97 points, marking its largest daily jump since January 2001 and the second best in its history.

Strong profits of 8.5% also recorded the minimum capitalization index Russell 2000.

The volume of trading was ranging in record levels, according to figures starting 18 years ago, as hands were about 30 billion shares.

A strong recovery was also recorded by many “heavy” cards on the US market, which had been under strong pressure due to the trade war in recent days. Indicatively, it is noted that Apple closed with a jump of over 15%, Nvidia’s stock recorded almost 19%profits, Walmart’s title scored almost 10%, while Tesla’s title jumped by 22%.

It is noted that as Donald Trump announced his decision to “freeze” the duties, Goldman Sachs published its revised report on the chances of recession of the US economy, which raised 65% from 45% earlier, with the investment bank.

Rally and in oil

A strong rebound was also recorded by oil, which returned more than $ 60 a barrel after Trump’s announcement.

In particular, the contract of future fulfillment of BrentJune delivery, extinguished the losses of 5% that recorded early today and closed with $ 2.66 or 4.23% to $ 65.48 a barrel, while the US crude type West Texas IntermediateMay, a May $ 2.77 or $ 4.65% jump at $ 62.35 a barrel, recovering from the low $ 55.12.

Jump over 7% for bitcoin

Trump’s change of strategy in the trade war caused a rally in cryptocurrencies, with the bitcoin Make a jump of over 7% to $ 82,305.55, according to Coin Metrics, marking a dramatic recovery from the low $ 74,567.02 day.

Strong profits of over 12% also recorded the Ether and Xrpwhile 14% jumped Solana.

New closure in “Deep Red” for Europe

The image of the stock markets on the opposite bank of the Atlantic, as Europe’s markets had been closed before the rally caused by Trump’s announcement, completing another meeting on “Deep Red”, although after the approval of the first Eurozone retaliation on the US duties.

More specifically, the pan -European index Stoxx 600 He scored 3.50%, while intra -conferences were losing more than 4%. Drop 3.31% recorded and the Euro Stoxx 50with the “heavy papers” of the eurozone.

Losses also recorded the individual stock exchanges, but they closed away from the low day.

In particular, the index DAX in Frankfurt fell 2.96%, the Cac 40 in Paris lost 3.34%, in Milan the FTSE MIB fell by 2.75%, while in Madrid the Ibex 35 closed 2.01% lower. With a drop of 2.92% finished transactions the index FTSE 100 in London.

Mixed image on Asian stock markets

The Asia -Pacific stock markets completed today’s meeting, with the exception of the indicators in China, who closed with small profits after Beijing’s new “retaliation” in the increase in tariffs on Chinese products to 104% by Trump.

In particular, in mainland China, the CSI 300 closed with a rose 0.99%, while the Shenzhen Component ended 1.22%. Also, in Hong Kong the Hang Seng index rose 0.68%, with Hang Seng Tech technology index winning 2.64%.

On the contrary, the index Nikkei225 in Japan closed with a fall of 3.93%, and the wider Topix with losses of 3.4%.

In South Korea, the index Kospi It fell 1.74% and entered a bear market, as it has fallen 20% of July high, while the Kosdaq low -capitalization index reports 2.29%.

Losses 1.8% recorded and index S&P/ASX 200 in Australia.

In new lows Chinese yuan

At the same time, Chinese Wan has closed its lowest level for more than 17 years on Wednesday.

Specifically, Wuan completed its domestic negotiation at 7,3498 per dollar, recording the weakest closure since December 2007.

The offshore yuan offset the losses and climbed about 0.7% to 7,3769 yuan per dollar in Asian transactions, with more than 1% to the previous meeting and reached a low record of 7,4288 overnight.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.