Income and property criteria for the return of a rent annually either for the main or for student residence – which retirees, uninsured elders and disabled

In the specialization of the three permanent support measures totaling 1 billion euros Earlier by Prime Minister Kyriakos Mitsotakis, in the wake of the primary record record recorded by the Greek economy, the Minister of National Economy and Finance Kyriakos Pierrakakis, Deputy Minister Nikos Papathanasis and Deputy Minister Nikos Papathanasis.

The measures, as the prime minister pointed out, will be permanently and will be added to the increases in wages, pensions and salaries and salaries and employees in the NHS.

As announced by the Ministry of Foreign Affairs, Mr. Pierrakakis, the aim of the measures is to spread a protection net for our vulnerable fellow citizens, adding that it is about it. Measures with a social and development sign.

According to Mr Pierrakakis, the safe labor is the surplus of 2024, which amounted to 4.8% of GDP, and added that these announcements were made now and not at the TIF because the surplus should be distributed within the year. He added that at the TIF the prime minister would announce the 2026 package.

According to the minister, measures are aimed at strengthening families paying rent, retired and vulnerable social groups such as uninsured elders and people with disabilities, adding that perimeter for all categories is expandedbut with income and property criteria.

In more detail:

In terms of rentalfrom this year the November will be returned to those who pay rent 1/12 of the annual declared rental whether it is a rent for a main residence or rent for student residence.

As the Minister pointed out, the income criteria are in line with those of the program “My house II“

The maximum amount for the main residence is up to 800 euros, with an additional 50 euros per dependent child up to 900 euros, while for student residence the maximum amount is also 800 euros.

Overall the maximum amount for rent and student residence is the 1,700 euroswhile if there is no main residence rent but rents for two student houses the maximum amount is the 1,600 euros.

In terms of income criteria, family income

– For the unmarried it is 20,000 euros,

– For the married one, 28,000 euros increased by 4,000 euros for each child and

– For single parent families 31,000 euros, 5,000 increased by 5,000 for each child beyond the first.

In terms of assets, the whole property for a single household should not exceed the 120,000 euros increased by 20,000 euros for each additional member of the household.

In the case of student residence for the allowance, the asset criterion does not apply and is only given on the basis of income.

According to the Deputy Minister of National Economy and Finance, 948,000 households, that is, about 1,280,000 taxpayers, are estimated to be beneficiaries of the measure, a percentage of about 80% of tenants in the country.

The total annual cost for the state budget is EUR 230 million.

250 euro allowance

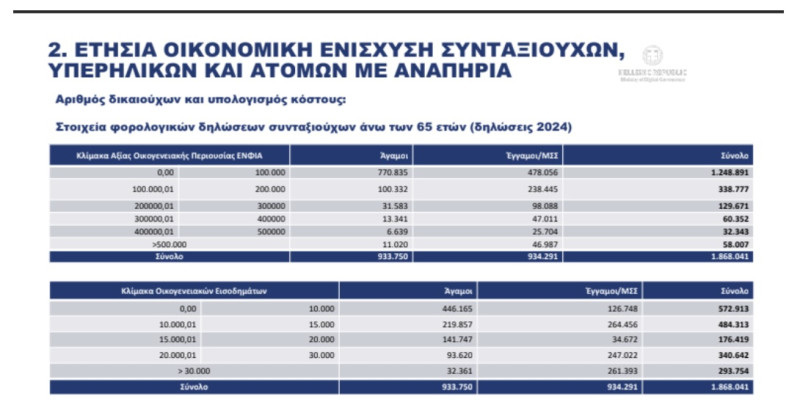

As for the 250 euro allowance given to retirees, uninsured elders and people with disabilities, it will be given until November 30 each year while beneficiaries are individuals over 65 years of age.

In terms of income and assets, income For the unmarried it should not exceed 14,000 and the fortune of 200,000 euroswhile for married people the income should not exceed The 26,000 euros and the property of 300,000 euros.

For uninsured elders and people with disabilities, the allowance is given without income or assets.

As Deputy Minister Thanos Petralias explained, although the two members are beneficiaries, they both receive it, but if a person is a beneficiary in two categories he receives an allowance.

Beneficiaries are 1,157,000 pensioners, a total of over 1,440,000 citizens.

The Minister of National Economy and Finance Kyriakos Pierrakakis, presenting the measures, said:

“The secure dying to make these announcements today is the surplus of 2024, which was made public recently. According to Eurostat official data, the primary surplus is 4.8% and the pure surplus is 1.3%. It is a very important conquest on which we can build.

Absolutely consistent with what we have told citizens to date, our design has a single axis: to turn the fiscal surplus into social capital, without risking the country’s stability – especially, I will add to the times we live in.

Today, at the heart of our announcements are families who pay rent for their main home, parents who are invited to pay rent for student residence, pensioners who are unable to increase their income in a other way. The perimeter of the beneficiaries in all categories is expanded, so that we can strengthen as many citizens as possible, but on the criteria of income and assets that ensure greater social justice.

We hear the citizens. We understand your anxieties and respond with interventions that are not limited to temporary solutions – on the contrary, we go to permanent solutions. And we fully realize that the roof is a right, it is not a luxury.

The support of pensioners is a matter of justice and dignity. Increases in their pensions in the last three years amounted to 13%, but it is our obligation to support them as much as we can.

The big projects are the footprint of a country that is being developed. With this FC, at these levels, we will have the largest public investment program in our history – until next, as it will be even greater.

The total annual cost of the above three measures is around € 1.1 billion and concerns about 2.7 million citizens, without calculating these numbers the development effect of the Public Investment Program.

Also, Minister Kyriakos Pierrakakis underlined:

“The surplus comes from three sources:

From the fight against tax evasion, by digital media. We have seen the role played by technology in the state, in transformation, the economy, and the fighting of tax evasion brings revenue to the funds. With modern digital tools and determination, we enhance tax and social justice.

From the growth of the economy, with wage increases and employment. In these six years, 500,000 new jobs were created, with salary increasing. This has an even more positive effect than we expected.

By saving government spending and reducing them by government bodies. The government has reduced more than 70 direct and indirect taxes and insurance contributions during these six years, at the same time that it supports citizens with measures that are now permanent and not occasionally, as was the case in the past. “

In closing the presentation of the measures, the Minister of Finance concluded:

“I think it is very interesting that tomorrow by representing the Treasury I will be on a panel where it will describe Greece as” a success story from the countries where the International Monetary Fund intervened “. Tomorrow is the anniversary that our country 15 years ago entered the first memorandum. I say it to understand the distance we have traveled.

We know that there are still people around us today who are being tested and we come to support with these measures. And she has not been gone by a government, she has been gone by a society, with a collective sweat, with a collective effort and with enormous difficulties especially in the depths of the past decade. “

Deputy Minister of National Economy and Finance Nikos Papathanassis said: “The Public Investment Program is a key pillar of economic growth and social progress. Through the implementation of infrastructure and reform projects, it helps to create jobs, enhance productivity and increasing economic activity. In addition, it promotes social cohesion, improves the quality of life of citizens and ensures sustainable development with social and environmental responsibility. The 2025 Development PDP is the largest of the last 15 years and is further reinforced by a complementary budget of € 500 million, now rising to € 14.6 billion. Overall, for the two years 2025-2026 it will amount to a record high of € 31.5 billion.

Additional resources will boost the National Side of the IPC and the projects being implemented under the National Development Program, with the available annual budget of national resources amounting to € 3.25 billion and € 2026 at € 3.3 billion.

This significant increase will fund a number of projects and interventions with a social sign and footprint at national, regional and local level.

The constant increase in resources available for public investment, as a result of our fiscal march, is a catalyst for achieving a durable and socially fair economic growth. “

The Deputy Minister of National Economy and Finance Thanos Petralias said: “The significant positive fiscal outcome of 2024 is mainly due to the efforts of Greek citizens. The decrease in tax evasion by increasing electronic transactions, the interconnection of cash with POS, the application of mydata, the application of the work card, and the faster reduction of unemployment and the increase in dependent work fees, all contributed to this result.

This result is a stockpile and gives us the budgetary margin for further reinforcement of citizens and the real economy in 2025, as well as in the coming years.

That is why today we are proceeding with significant permanent measures by implementation in 2025. The rental refund comes to give an immediate response, reinforcing the income of tenants, with enlarged income limits, to include much of the middle class. The financial support of pensioners over 65 years of age, elderly and disabled people is a social measure for our citizens who need it. Strengthening the Public Investment Program enables the great projects to be accelerated, enhancing the growth course of our economy.

The above is proof that when fiscal policy is stable and responsible, space is created to strengthen the community as a whole. But everything is always done within the budgetary targets, which is the only way to improve the standard of living of citizens. “

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.