Greece among the most vulnerable tariffs among the emerging economies of Europe, the Middle East and Africa, according to a UBS report on the impact of the US president’s tariff policy.

Specifically, Greece is ranked fourth among the emerging countries of the EMEA region that will be more affected by US duties behind Hungary, which will receive the strongest blow, the Czech Republic and Poland.

Sensitivity analysis for proposed new US duties

UBS in its analysis of the impact of Trump duties on emerging economies of Europe, Middle East and Africa, raises two questions:

a) What could be the expected risk of GDP growth in 2025 and 2026 (taking into account the direct and indirect impacts together) and

b) What is the degree of sensitivity to an increase in pay duties by 10%.

For the time being, UBS is not changing GDP forecasts at this stage, given the uncertainty about where the duties will eventually be formed, as trade negotiations with the United States are still ongoing.

For 2025, UBS expects growth from 1% (Hungary and South Africa) to 3.5% -4.0% in the United Arab Emirates and Saudi Arabia. For 2026, the scatter is lower with growth rates ranging between 2.0%-4.5%.

UBS has incorporated four sets of information into its estimates. First, a 10% universal duty from the US according to the April 9th decision to suspend mutual duties and, secondly, the amount of the April 9th sectoral duties under Article 232 (ie, 25% duties on steel, aluminum and cars, and cars, as well as

Second, the data on the first quarter of GDP. Third, a subset of data for the second quarter where information is available. Fourth, in the case of Saudi Arabia and the UAE, the impact of OPEC+ decisions on gradual abolition of previous production cuts.

Suggested new real tariffs for affected countries

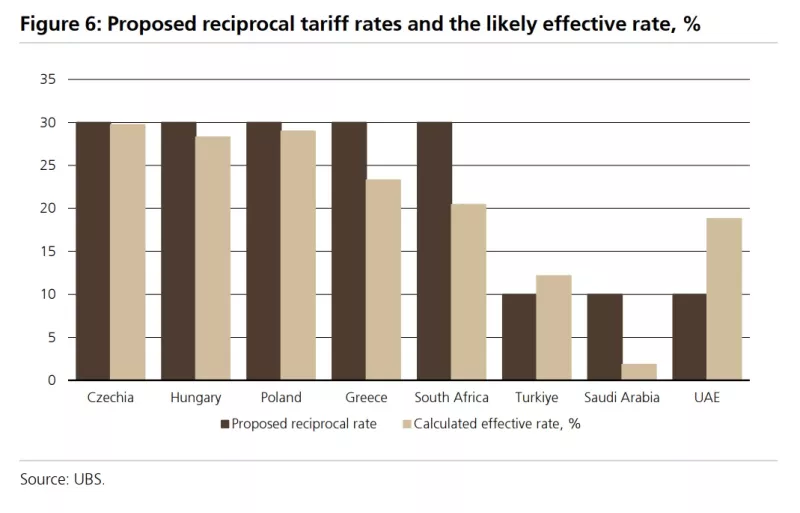

The US president proposed a 30% reciprocal duty rate for the European Union, 30% for South Africa and 25% for Kazakhstan.

The announced duties for South Africa and Kazakhstan are quite close to the tariffs imposed on “Liberation Day” on April 2 (31% and 27% respectively). The new proposed duties would mean that real tariff rates to exports to the US would increase to 20% -23% for Greece.

The real tariff rates for countries that have not received new proposed duties are practically zero for Saudi Arabia, about 10% for Turkey and about 20% for the UAE.

This means essentially triple the actual tariff coefficient for the Czech Republic, Hungary, Poland and Greece, and doubling the tariff rate for South Africa.

GDP burden

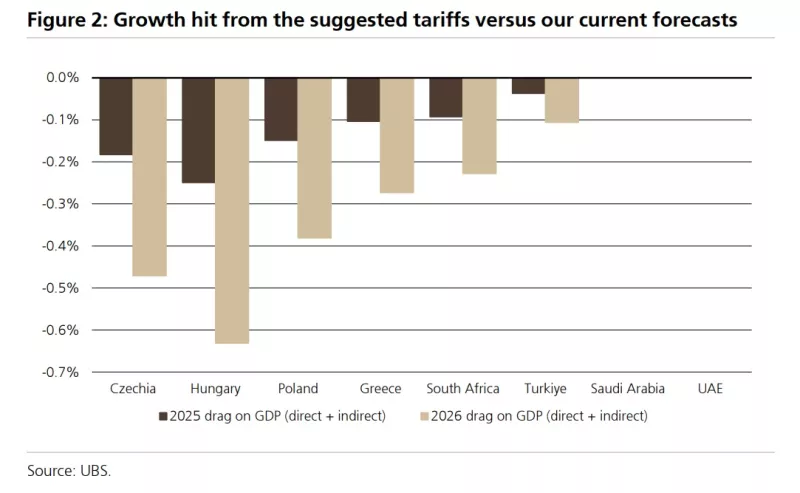

UBS estimates that the full burden of growth by the proposed duties in relation to its current forecasts will be 0.45% for Hungary, 0.3% for the Czech Republic and Poland, 0.2% for South Africa, 0.15% for Greece and 0.10% for Kazakhstan, noting that 20%.

In terms of the indirect impact, in 2025 the blow to GDP will be about 10 basis points and in 2026 about 30 basis points in the event of a 30%tariff rate. As a result, UBS argues that the combined direct and indirect blow to GDP from the proposed higher US duties will be quite marginal (10-20 basis points) for 2025. For 2026 there will be a more intense blow to GDP by 10 to 60 basis points, with the country being affected by Greece and South Africa.

Which countries are most affected

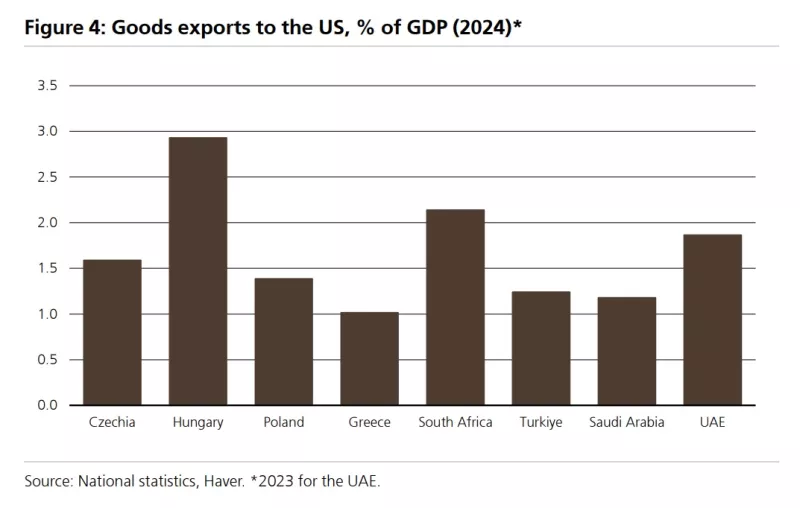

Countries with the largest share of exports to the US under Catholic duties are: a) the Czech Republic, Poland and Turkey (will be affected by 90% of exports) and

b) Hungary, Greece and the UAE (60-75%).

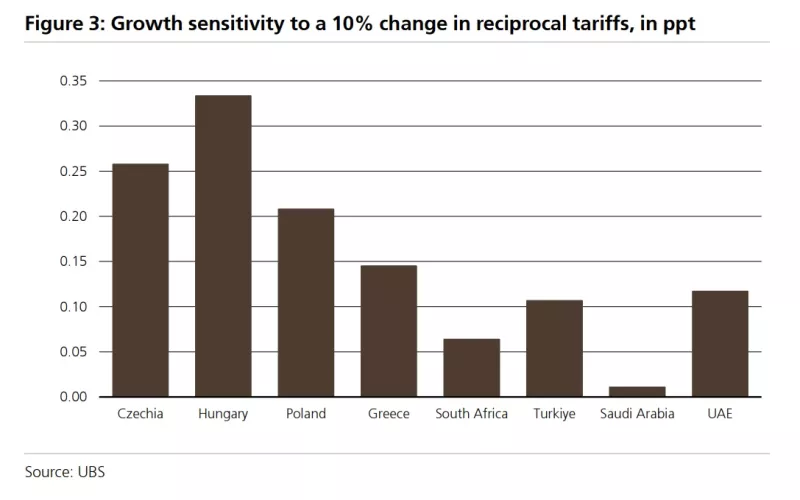

All other countries have much lower weights than mutual duties. Overall, UBS simulations indicate that the negative impact of a 10% increase in mutual duties would be in the Czech Republic and Hungary (25-30 basis points), followed by Poland and Greece (15-20 basis points), and then by Turkey and 10 points.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.