(News Bulletin 247) – Another hesitation session yesterday on Wall Street as several macroeconomic news items are stirring up investors. Indeed, last night the markets discovered the Fed’s minutes. Reading the minutes, traders were able to learn that several Federal Reserve officials acknowledged that there were plausible arguments in favor of reducing interest rates at their meeting on July 30 and 31. This reassures the market about future rate cuts this year. The markets are banking on an easing of around 100 basis points for the rest of the year. Still on the macroeconomic front, news from the U.S. Bureau of Labor brought volatility. The institution published a document in which we can see that employment growth in the United States was probably much less robust during the year up to March than previously announced, which kept the pressure on the Federal Reserve to reduce interest rates next month. The initial BLS payroll numbers showed employers adding 2.9 million jobs overall, an average of 242,000 per month. Now, the monthly pace is more likely to be around 174,000. That’s the largest downward revision since 2009. On the geopolitical front, U.S. President Joe Biden continues to pressure Israeli Prime Minister Benjamin Netanyahu on the “urgency” of reaching a ceasefire agreement to end the war in Gaza and secure the release of Israeli hostages held by Hamas. The latter, combined with a weaker U.S. economy, as seen in employment data, has continued to put downward pressure on oil. On the microeconomic front, Edgar Bronfman Jr. upgraded his offer to buy Paramount to $6 billion in a bid to circumvent the Hollywood company’s deal with Skydance Media. The cosmetics chain Sephora China, which belongs to the LVMH group, is cutting jobs, “less than 3%” of the 4,000 employees in China. Investors will have a busy schedule today, first of all, with the many macroeconomic publications. This morning, we are expecting the PMI activity indices in the eurozone, Germany and France. At the end of the morning, the same figures will be published in the United Kingdom, then at 1:30 p.m., operators will take note of the minutes of the European Central Bank. Finally, across the Atlantic, at 2:30 p.m., we are expecting the weekly unemployment registrations, the PMI activity indices as well as the sales of existing homes. A new wave of companies are due to publish today, including Intuit, Baidu, Dollar Tree, Cava, Williams-Sonoma, etc.

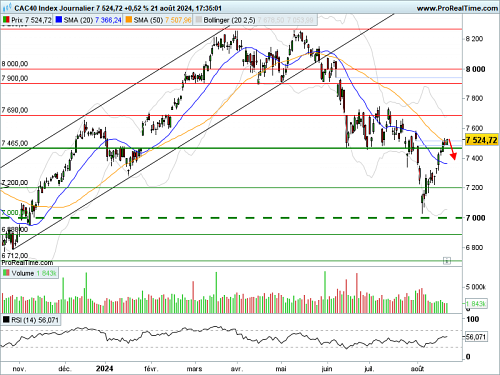

Technical Section: The Paris index is still in a short-term zone of turbulence where sellers’ inclinations may reappear while the index has been working for several days in an important weekly zone. We will still wait for a return to the 20-day moving average to take a long position.

FORECAST

Considering the key graphic factors that we have identified, our opinion is neutral on the CAC 40 index in the short term.

It should be noted that a crossing of 7690.00 points would revive buying tension. While a break of 7465.00 points would revive selling pressure.

The News Bulletin 247 council

Hourly data chart

Daily data chart

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.