(BFM Stock Exchange) – This article, with free access, is produced by the research team in BFM Stock Exchange analysis and market strategy. To not miss any opportunity, consult all of the analyzes and discover our portfolios by accessing our privilege space.

The CAC 40 is expected to decrease this Friday in a very tense geopolitical context, after the massive Israeli strikes targeting Iran.

Israel proceeded to a “preventive strike” against Iran, the Israeli Minister of Defense said on Friday, June 13, after the US President Donald Trump warned that Israel could soon strike Iranian nuclear sites. Prime Minister Netanyahu has announced that Israel struck “at the heart” of the Iranian Uranium enrichment program.

A new cycle of discussions between American and Iranian officials was scheduled for Sunday in Oman as part of the negotiations between the two camps for a new nuclear pact, against the backdrop of acceleration of the Tehranium Uranium enrichment program.

Hossein Salami, the commander -in -chief of the revolution guards, was killed last night.

Already yesterday, the geopolitical tensions, before the strikes proper, had caused an opening of the tricolor flagship index in a lowered gap, before a filling during the session, for a fence symbolically in the red (-0.14% to 7,765 points).

In the statistical chapter Thursday, operators learned of an advanced indicator of very reassuring inflation, production prices, which increased in May only 0.1%, under the target defined by consensus. In addition, the American Labor Department has just unveiled 248,000 new registrations for unemployment benefits over a week, a figure relatively close to expectations.

On the values side, we will very carefully monitor the (Para) petroleum titles this Friday, due to a jump of almost 15% of the price of the barrel. Air France (-7.3%), whose fuel bill is one of the main spending stations, was penalized. On the side of small and medium-sized capitalizations, Clariane, the former Korian jumped 15.4% after announcing the sale of its grandson network to Crédit Agricole Santé et Territoires, which completes its asset sale program of 1 billion euros.

On the other side of the Atlantic, the main shares on shares have finished symbolically in green, like the Dow Jones (+0.24% to 42,967 point) and the Nasdaq Composite (+0.24% to 19,662 points). The S & P500, a reference barometer of appetite for the risk in the eyes of fund managers, nibbled 0.38% to 6,045 points.

A point on the other asset classes at risk: around 8:00 am this morning on the exchange market, the single currency was treated at a level close to $ 1,1540. The barrel of WTI, one of the barometers of appetite for the risk on the financial markets, was exchanged around $ 71.75. THE Treasuries 10 Yearsyield of federal sovereign bonds due to 10 years, was negotiated slightly above 4.32%. As for the Vix, it was worth 18.02 at the last fence of the S&P500.

At the macroeconomic agenda this Friday, to follow in priority industrial production in the euro zone at 11:00 am, and the preliminary data of the consumer confidence index (U-Mich), at 4:00 p.m.

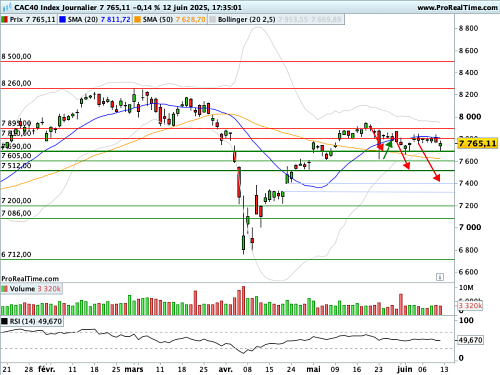

Key graphics elements

The gradual cap under the 7,900 points has suddenly turned into intense volatility. In one session Friday, May 23, the Parisian flagship index broke the Dynamics of the spring rally by breaking the mobile average at 20 days (in dark blue), the difference compared to the mobile average at 50 days (in orange) has taken up strongly.

The 7,900 points are reinforced in their status of graphic resistance, even though the dynamics of the relative force index invite caution. Indeed the RSI (Relative Strenght Index) Adopt a persistent lowering bias since May 13. The tricolor flagship index is now in a glaring situation of incapacity for creations of new heights.

First alert Thursday, June 12 with a metal gap in session. We will therefore monitor the lowering gap formed this Friday (magnitude, level of the filling if necessary).

FORECAST

In view of the key graphic factors that we have mentioned, our opinion is negative on the CAC 40 index in the short term.

This downward scenario is valid as long as the CAC 40 rating index below resistance at 7810.00 points.

The News Bulletin 247 Council

Hourly data graphics

Daily data graphics

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.