(BFM Stock Exchange) – This article, with free access, is produced by the research team in BFM Stock Exchange analysis and market strategy. To not miss any opportunity, consult all of the analyzes and discover our portfolios by accessing our privilege space.

The surprise resignation of Sébastien Lecornu, only a few hours after the announcement by the Élysée of the composition of his government, AA had the CAC 40 under the threshold of 8,000 points, symbolic and psychological level dearly acquired last week.

This shock wave revives the spectrum of a political blocking with the absence of measures necessary to clean up the trajectory of tricolor public finances. “The resignation of Lecornu plunges the political scene into uncertainty. Investors fear a domino effect on economic and budgetary policy”, analyzes Antoine Andreani, head of research actions at XTB France. Which set out the French 10 years once above his Italian counterpart.

The SPREAD reached 85 base points (0.85 percentage points) after exceeding 88 base points in the morning. “A record since January!”, Note Romane Ballin, bond manager of Auris Gestion.

“Faced with the freezing reception reserved for its new government, S. Lecornu presented its resignation in the morning, less than a month after its appointment. The institutional blocking which paralyzes the Fifth Republic thus seems far from being resolved: whether we are heading towards a dissolution or the appointment of a new Prime Minister, the pressure on sovereign rates should persist. Should we be inquired of a budgetary Shutdown? This appears unlikely: the resigning government will be able, as last year, in December tabled a special bill which allows the State to continue to collect taxes, to renew the credits, and therefore to finance public services, on the same basis as the previous year. “

Several sectors have suffered on the Paris Stock Exchange. Whose banks, which are on the front line of this risk aversion movement. Société Générale lost 4.2%, BNP Paribas 3.2%and Crédit Agricole SA 3.4%. Thales fell 3.2%. The political hazard in France could delay the adoption of a finance law and therefore of the defense budget for 2026. This can constitute a source of uncertainty for the market. On the CAC 40, Stellantis (+3.5%), ArcelorMittal (+1.6%) Totalnergies (+0.5%) and Pernod Ricard (+0.5%), escape this lower movement.

On the other side of the Atlantic, the main shares on shares ended again in dispersed order, the contractor Dow Jones of 0.14% and the Nasdaq Composite winning 0.71%. The S & P500, reference barometer of appetite for the risk in the eyes of fund managers, nibbled 0.36% to 6,740 points.

A point on other asset classes at risk: around 8:00 am this morning

> On the exchange market, the single currency was treated at a level close to $ 1,1690.

> The barrel of WTI, one of the barometers of appetite for the risk on the financial markets, was exchanged around $ 61.90.

> THE Treasuries 10 years, yield of federal sovereign bonds due to 10 years, were negotiated slightly above 4.16%.

> As for the Vix, it was worth 16.30 at the last fence of the S&P500.

At the macroeconomic agenda this Tuesday, to follow in priority at 6:10 pm a speech by Mrs. Lagarde, president of the ECB.

Key graphics elements

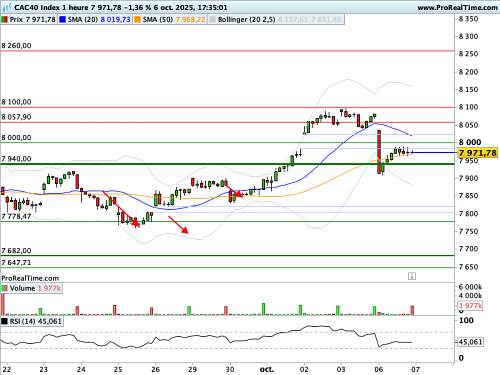

While the CAC had just freed a major resistance, on ample Gap (October 02), the session of October 06 came to change the situation. The Gap mentioned, although ample and trained on both sides of the 8,000 points, can no longer be qualified as a rupture gap (Breakaway Gap). This strongly questions the scenario of an immediate upward extension towards the 8,260 points.

FORECAST

In view of the key graphic factors that we have identified, our opinion is neutral on the CAC 40 index in the short term.

We will take care to note that a crossing of the 8260.00 points would revive the tension to the purchase. While a break in the 7682.00 points would relaunch the selling pressure.

The News Bulletin 247 Council

Hourly data graphics

Daily data graphics

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.