The minister of territory mentions it in his post

The Minister of State focuses on two economic figures, the GDP and the public debt, in his post on Facebook Akis Schertsosand even “during two exogenous mega-crises, health and energy”, as he points out.

In detail “the first graph shows the growth of national income from the last quarter of 2019 to the first half of 2022. Despite the global and national recession caused by the pandemic and lockdowns, the Greek economy managed to grow cumulatively in the last 33 months by 5 points According to the draft 2023 budget tabled this week in Parliament, the GDP it is estimated that it will reach 210 billion euros in 2022 from 183 billion euros in 2019. In the same period, the eurozone shows a growth rate of twice as much, and Germany almost zero.”

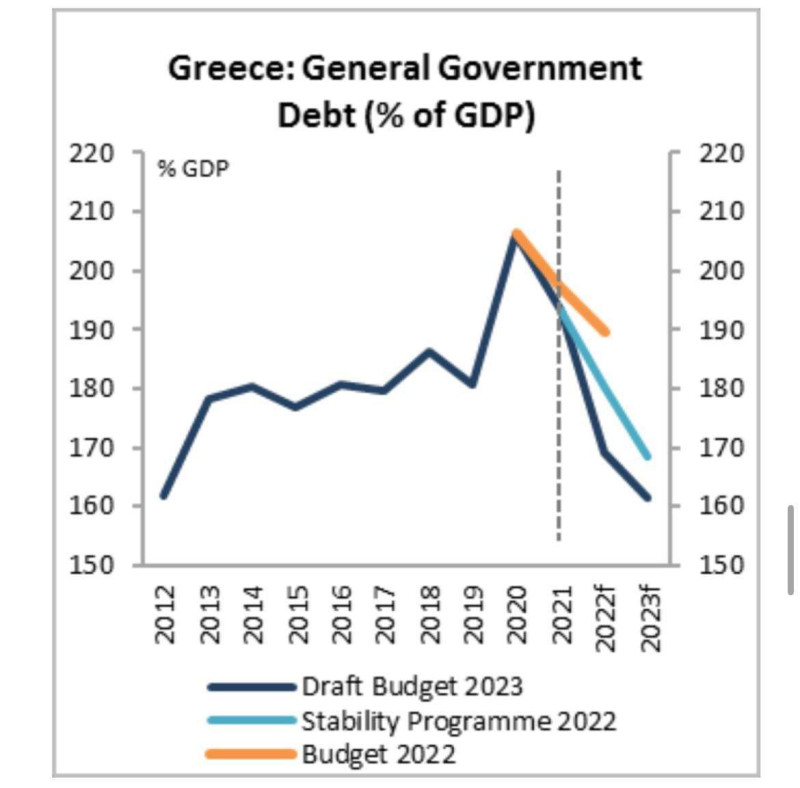

While the second graph “depicts its rapid de-escalation public debt after the temporary increase in 2020 when the state inevitably became the employer of almost the entire economy during the lockdowns. Again according to the 2023 draft budget, General Government debt is estimated to be €355,000 million or 169.1% as a percentage of GDP at the end of 2022, compared to €353,389 million or 193.3% as percentage of GDP in 2021, showing a decrease of 24.2 (!!!) percentage points compared to 2021. In 2023, the debt of the General Government is projected to be 357,000 million euros or 161.6% as a percentage of GDP, presenting a further reduction of 7.5 percentage points of GDP compared to 2021. In practice, we are talking about the fastest reduction of public debt in the EU and this in conditions of forced fiscal expansion”, the Minister of State underlines.

From the reading of the two graphs, according to ‘A. Scherzo, three conclusions:

Firstly“the most effective economic policy is counter-cyclical policy. With fiscal expansion, that is, with budgeted deficits in recessions – which support jobs, businesses and the vulnerable – and surpluses in growth, which lead to national savings for the hard times that will eventually come some point”.

Secondly“targeted reductions in taxes on capital and labor lead to a more attractive investment environment and ultimately to a virtuous economy of more investment, new jobs, higher revenues and incomes.”

And, thirdly“the rapid reduction of the public debt does not come through strict austerity and the obsession with over-taxation and high surpluses, but through the dynamic increase of the ‘denominator’ i.e. the country’s GDP”.

Read the News today and get the latest news.

Follow Skai.gr on Google News and be the first to know all the news.

I have worked in the news industry for over 10 years and have been an author at News Bulletin 247 for the past 5 years. I mostly cover technology news and enjoy writing about the latest gadgets and devices. I am also a huge fan of music and enjoy attending live concerts whenever possible.