The figures show that in the European elections the ND came first among the self-employed, losing almost 17 whole points

By Chrysostomos Tsoufis

Ready to proceed with corrective actions in the presumptive way of taxation of freelancers and self-employed, if the need arises, the government declares.

Speaking to ALPHA o Prime Minister he stated that the feeling of injustice that some taxpayers may feel is understandable and that if gross injustices are found, then there will be partial corrections.

Along the same lines, the Minister of Finance stated on SKAI radio that the better and better use of technology will allow a “closer to reality valuation of the income” of freelancers and the self-employed.

The data show that on European elections ND came first among freelancers, losing almost 17 whole units. From 44.7% of last year’s national elections in June, to just 28.2% on Sunday.

Leading ministers of the government put this tax reform in the framework of the causes of the electoral losses. Kostis Hatzidakis of course defends it by emphasizing that on the one hand the same system is followed by countries such as France and Italy, on the other hand it is combative with 9 categories being excluded and can be disputed with the simultaneous consent of the taxpayer in an audit.

Kyriakos Mitsotakis spoke of “wrong language” that was sometimes used and of a measure that could have been better communicated.

The data so far from the process of submitting the tax returns probably vindicate him Kostis Hatzidakis. Of the 75,166 self-employed and self-employed tax returns, only 37,943, i.e. almost half, fall under the presumption. 37,223 have self-declared higher amounts than the presumed ones.

Of the 37,943, only 255 have chosen to dispute the presumptive method of taxation, a percentage that is only 6 per thousand.

We will know whether corrections are finally required, to which the government declares it is open, after processing the data of this year’s tax returns.

In any case, in 2 cases “caught” by skai.gr, the burden that arises is only negligible and the writer is surprised by the very low number of disputes.

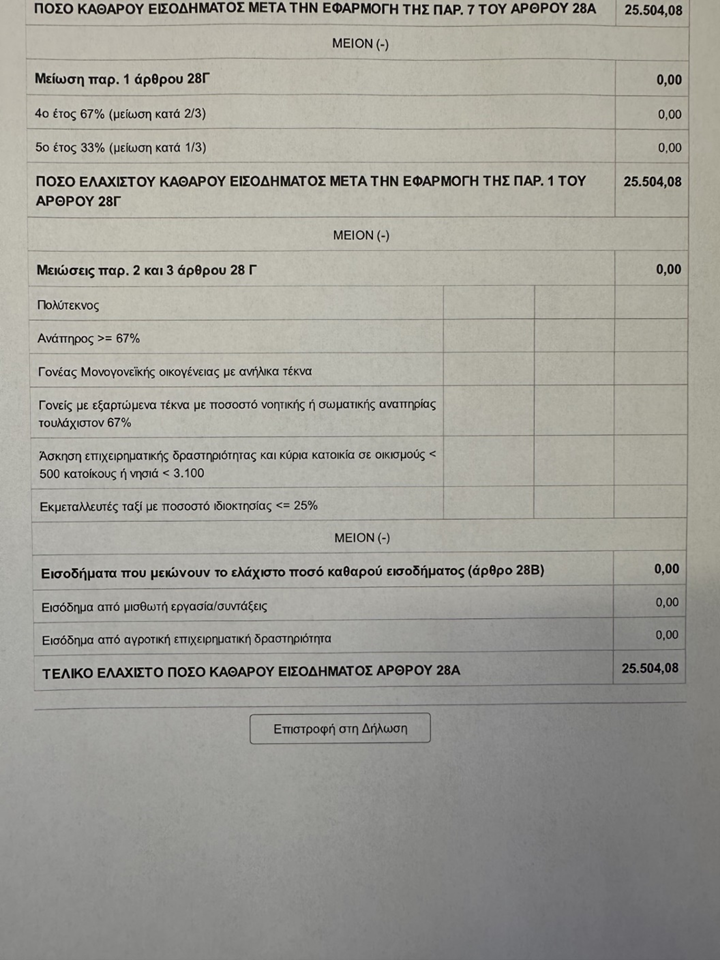

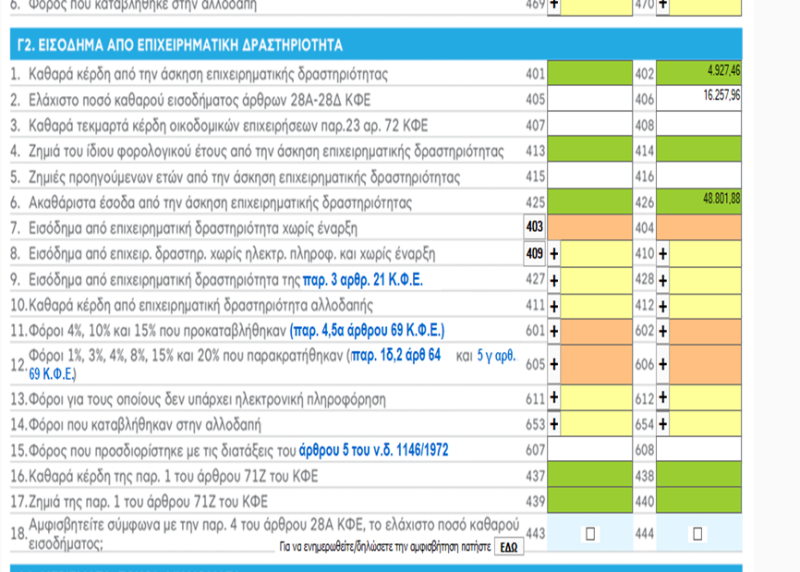

In the first example of a tutoring school, its actual declared income is €16,500 which corresponds to a tax of €2,330 without advance tax. However, the imputed income as calculated with the assumptions set by the Ministry of Finance is €25,504, which corresponds to a tax of €4,641, again without the advance payment. An increase in the tax burden of 99%.

In the second case we have a tutoring school which declares a net income of €4,927 and corresponds to a tax of €492.7. However, the presumptive income is set at €16,257, so it will be taxed at €2,276.54, a charge of 362%.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.