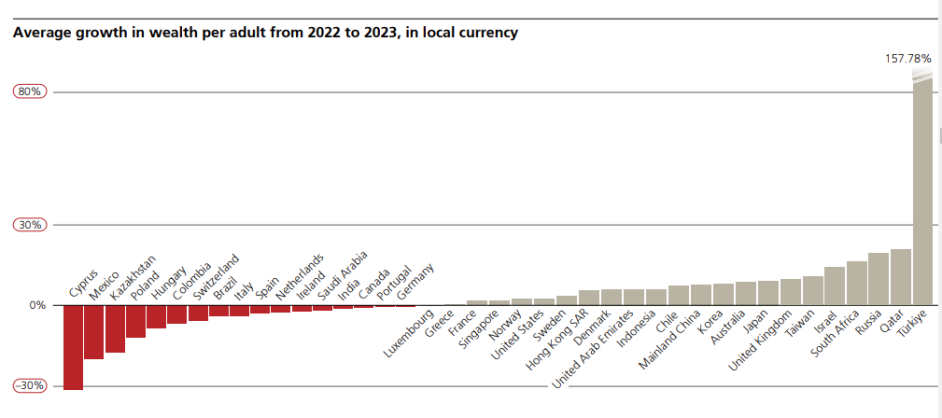

In the increase of average wealth per adult, Turkey is followed by Russia and Qatar

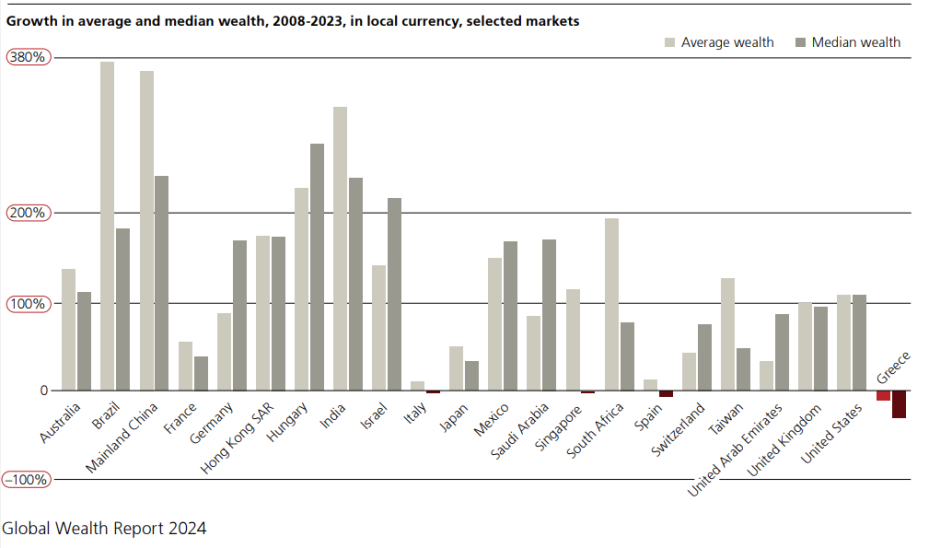

An 11% drop has been recorded in the average wealth in Greece in the period 2008 – 2023, according to a report by the Swiss bank UBS, on global wealth (Global Wealth Report 2024).

Even greater is the drop in median wealth – which as a term best describes the center of wealth distribution – which saw a 31% decrease. In other words, the rich get richer and the poor get poorer.

Turkey “left ahead” with an explosion of 157%

Turkey at the same time “ran ahead”, leaving the rest of the countries miles behind in the annual global wealth ranking. This fact is surprising, according to CNBC given its high inflation.

In particular, as the Swiss bank UBS wrote in its report on global wealth (Global Wealth Report 2024), “Turkey stands out with a staggering increase of over 157% of distributed wealth per adult in the period between 2022 and 2023, leaving the rest of the states well behind”.

In the increase in average wealth per adult, Turkey is followed by Russia and Qatar with almost 20% and South Africa with an increase of more than 16%. In the US average wealth per adult increased by 2.5%.

Inflation remains high in Turkey – How wealth increased

Inflation in Turkey, however, has remained stuck at the particularly high rate of 72%. The country’s roughly 85 million citizens have faced a dramatic decline in their purchasing power in recent years.

Over the past five years, the pound has fallen 83% against the dollar and was at 33 pounds to the dollar at 09:07 on Wednesday.

However, for Turks owning real estate, wealth increasedas inflation has pushed up the value of this property.

The UBS report defines net worth per adult as “the value of financial assets plus real estate less the owners’ debts.”

“In a way, high inflation explains the reason for such a large increase in local currency terms, compared to other countries, given that wealth is valued in nominal terms,” Samuel Adams, an economist at UBS Global Wealth Management, told CNBC.

“If inflation is very high, real estate values tend to rise in line with inflation, if not faster,” he added. “Therefore property owners or those who own stocks, who also tend to perform accordingly in such environments, see their wealth accumulate a little faster.”

“Of course, that doesn’t mean everyone benefits equally,” Adams added. “If someone doesn’t have real estate assets and if their salary increase can’t keep up with inflation, they’re going to be adversely affected by the situation.”

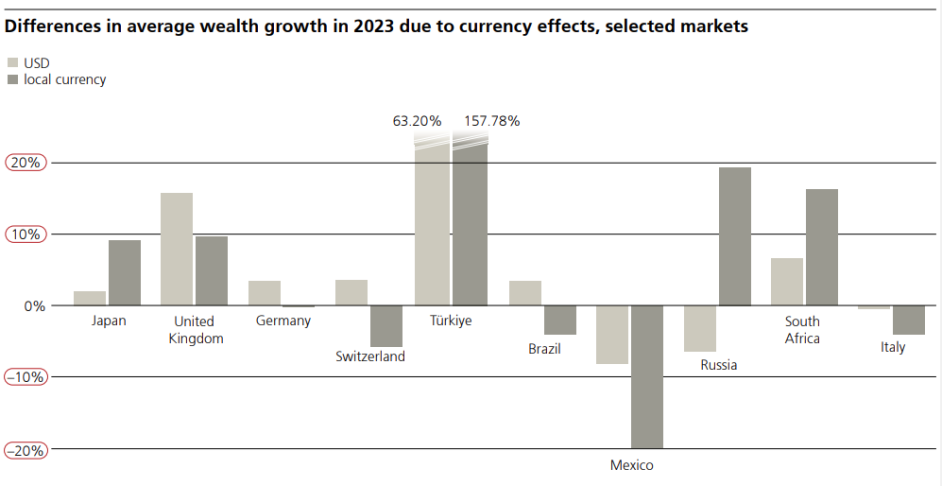

The local currency phenomenon

“Currency effect,” according to the UBS report, is what changes the wealth growth figures to local currency terms. They are often significantly different compared to what is presented in dollar terms.

“Turkey’s already outstanding growth of over 63% in US dollars more than doubles to almost 158% in Turkish lira terms,” it said. Other examples in the report included Japan, which in dollar terms has seen less than 2% average growth in wealth per adult between 2022-23, but in local currency the growth was 9%.

Assessing the countries’ average wealth growth between 2008 and 2023, “the most impressive development occurred in Turkey,” UBS wrote, “where average wealth per adult over this time period increased by 1,708% in local currency.”

Asset rich but cash poor

UBS Global Wealth Management chief economist Paul Donovan pointed out that being rich in assets does not necessarily mean you are rich in cash in Turkey. It could, in fact, mean the opposite.

“When it comes to living standards rather than wealth, it’s also important to remember that if you own a home, the value of your home has increased, but at the same time your real salary may have been negatively affected. So you can be asset rich and cash poor,” Donovan pointed out last week.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.