Its customer since 1895 Eleftherios Venizelos – the Germans won the Korai Street in 1941 and Kommandantur turned its basements into prisons into prisons

He is 134 years old. He has been confronted with the Balkans, 2 worldwide and a civil war, national disasters, and in 1922 he paid over eight million drachmas to the insured protagonists of the tragedy of Asia Minor and despite the obstacles, he seems to have succeeded. Since yesterday, National Insurance has been writing a new chapter in its history as it has passed the control of Piraeus Bank.

134 insurance

The history of National Insurance begins in 1891 in the historic National Bank building on Aeolou Street. Its founding statutes are signed by National Bank Governor Pavlos Kalligas, and personalities of the country’s banking and financial life.such as George Athinogenis and Stefanos Strait. Purpose: “The underwriting of all kinds of insurance and reinsurance”. Duration: “Unlimited”.

A few years later, It is transferred to its first privately owned seat, the former Rossels house at 8 Korai Street. With her Eleftherios Venizelos client since 1895National Insurance is pioneering, advertising life insurance in the newspapers of the time.

In 1910, the Greek state for the first time regulates private insurance with two laws drawn up by prominent members of the Board of Directors of National Insurance.

Since the start of the Balkan Wars, the First World War, Until 1922, the crucial year of the Asia Minor Disaster, Despite the adverse conditions, the company’s premiums increase by 50%.

In the great fire of Thessaloniki in 1917, the National will cover immediate losses of two million eight hundred thousand drachmaswhile the one million two hundred thousand that corresponds to her is almost the equal of its share capital. In 1922 the company’s branch in Smyrna will pay over eight million drachmas to insured protagonists of the tragedy of Asia Minor Disaster.

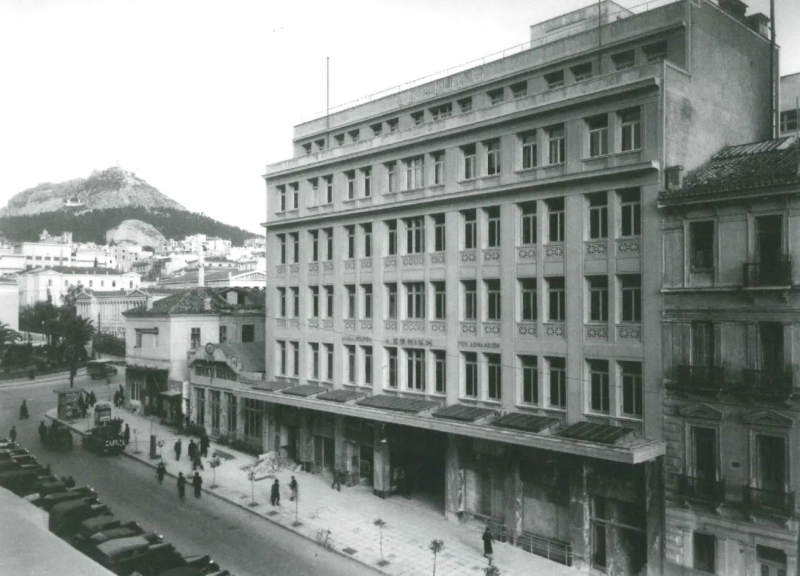

During the interwar period (1923-1940), National Insurance has great financial health and guides developments. It proceeds with the erection of the Korai Hall, “Lived It East of It”, and is preparing to celebrate its fifty years in 1941.

In 1940, the Board of Directors’ report heralds the beginning of a sad five -year period for Greece: “Our company, consistent with its traditions, in no way lacked in his fulfillment to his homeland, contributed to a brave contribution to the support of the National Struggle. “

Occupation 1941-1945

The 50th anniversary celebration was not possible by occupation, but on May 6, 1941, The Germans will end the newly built building on Korai Street and Kommandantur will turn its basements into prisons. At the top of the mansion is now waxed by the anchor cross.

In the summer of 1942, Lykourgos Kanaris organizes food for workers and their families in Athens and Thessaloniki. It thus ensures one serving of legumes a day for 120 mouths and at the same time National Insurance helps, by means of survival, in the survival of the capital’s hunger.

The layout of the building continues after the liberation, this time by the Headquarters of the National Liberation Front – EAM, then by the English military forces and then by the electric companies. The National Insurance, which had been transferred to Sophocles in 1941 in 1941, never returned to Korai.

Reconstruction 1950-1969

In the early 1950s, the upward course of work reflects efforts to rebuild National Insurance, Despite the deterioration of the international and consequently the Greek economy.

In the coming years, the sectors of fire, life and transport will have excellent results, as opposed to the accidents and agricultural insurance sectors, affected by the establishment of IKA and OGA. In 1963, chaired by Dimitrios Helm, Vice -President George Pesmazoglou and General Manager Emmanuel Hatziandreou, National Insurance again acquired a privately owned Kallimarmaro Palace at the beginning of Karageorgi Serbia, Designed by international Greek architect Jason Rizo.

In 1964 he will establish the Societe Anonymous Hellenic Ship Insurance Company with a capital of £ 500,000. In 1966, due to the connection of the country with the EEC its Board of Directors “In a timely manner, it has reached out the universal computer as possible.”

The entry to the EEC and the merger

In 1979 it was marked by the country’s entry into the EEC. The National Insurance, an advocate of the European Idea, more than doubles its premiums in the general sectors and achieves a 15.2% increase in the life industry. The company’s network consists of 46 branches and 317 agencies.

In 1991, on the anniversary of its establishment, National Insurance shows a 26% increase in revenue and 91.06% increase in net profits. Its dynamics are constantly increasing and culminating in 1997 mWith the completion of its merger with ASTIR, ETEVA and PANELLINI, which places it in the leadership position of the insurance market with a 20% market share, 21 billion drachmas equity and reserves, 5,000 partners and 1,500,000 customers.

In 2001, on the anniversary of the hundred years since the establishment of National Insurance, excavations on the plot of Syngrou Avenue began to erect the new building complex that will house all its functions.

The goal of the Karatza administration For a robust presence, views of the Acropolis and a microclimate, it is implemented by the award -winning architect Mario Botta. The inauguration takes place on June 14, 2006 and National Insurance is solemnly celebrated in its 115th anniversary.

By National Bank to CVC

March 31, 2022, marks a new chapter for National Insurance as this date The National Bank transferred 90.01% of the company’s share capital to the CVC Capital Partners’ Fund VII (“CVC”).

The transaction included the sale and transfer of all EIB insurance shares to the newly established CVC subsidiary: Ethniki Holdings S.à.RL, and the EIB Market 9.99% in Ethniki Holdings S.RL share capital

And from CVC to Piraeus Bank

Yesterday’s deal opens a new chapter for National Insurance which now left the CVC umbrella and joined the Piraeus Bank chariot.

The financial results

The last year of National Insurance recorded strong performance in all areas of activity, with a significant increase in premiums and further strengthening its market share.

In particular, in 2024, National Insurance increased 15.8% in registered premiums (Gross Written Premiums – GWP), significantly exceeding the market average, which stood at 8.7%. As a result, the company’s market share is expected to be 14.6%, compared to 13.7% in 2023.

National Insurance CEO, Dimitris Mazarakis, said: “Our performance for 2024 confirms our strategy for the overall transformation of the company – from strengthening the sales network and upgrading internal processes to targeted investment in technology and human resources. We continue steadily on the path of growth and modernization, with the aim of producing any time.

In the life industry, the company recorded a increase of 16.8%, compared to 7.9% of the average market, mainly due to increased demand for unit-Linked products.

In Health Insurance, the rate of development of national insurance was twice as high as the rest of the market, proving its strong presence in the industry.

In general insurance, there was a 14.4% increase, compared to 9.4% of the market, with remarkable performance in all basic sectors. Particularly in property insurance, the company’s growth rate was 1.6 times higher than the market average.

Photos are from the National Insurance Website

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.