(News Bulletin 247) – The continuation of Beijing’s “efforts” to soften a health policy that has become unbearable for a section of the population is not enough to reassure a market that is worried about the recent signs of overheating of the American economy ( NFP, ISM Services), signals that sweep away hopes of an accommodative attitude from the Federal Reserve.

The ISM services index, which came out sharply up at 56.5 on Monday, resonated with the latest federal employment report, like so many signs of chronic overheating in the American economy, major points of attention for the Fed in the construction of its monetary policy for the coming months. The challenge, beyond the shape of the yield curve, which should gradually flatten, is that of identifying, at this difficult stage, a “terminal rate”.

“So far, the markets have convinced themselves that the Fed seems on the right track to lower inflation, without having to push the economy into recession. Thus, cyclical stocks, sensitive to economic conditions, have accelerated sharply since then. the month of October, leading some of them to new all-time highs”, notes at this stage Vincent BOY, market analyst IG France.

Yesterday in terms of statistics, let us point out a weaker than expected widening of the deficit (structural, let us recall) of the American trade balance, at -78.2 billion dollars in October.

On the value side, Quadient plunged 17.9%. The former Neopost was forced to adjust its ambitions for 2022 after posting weaker-than-expected organic growth in the third quarter. ADP for its part dropped 12.6%. Airport operator and Amsterdam airport operator Royal Schiphol have unwound their cross-shareholdings.

On the other side of the Atlantic, the main equity indices fell on Tuesday, like the Dow Jones -1.03% to 33,596 points) or the Nasdaq Composite (-2.00% to 11,014 points ). The S&P 500, the benchmark barometer of risk appetite in the eyes of fund managers, fell 1.44% to 3,941 points.

A point on the other risky asset classes: around 08:00 this morning on the foreign exchange market, the single currency was trading at a level close to $1.0460. The barrel of WTI, one of the barometers of risk appetite in the financial markets, was trading around $76.30.

To be followed as a priority on the statistical agenda this Wednesday, the revised quarterly GDP data in the Euro Zone at 11:00 a.m., and crude stocks across the Atlantic at 4:30 p.m.

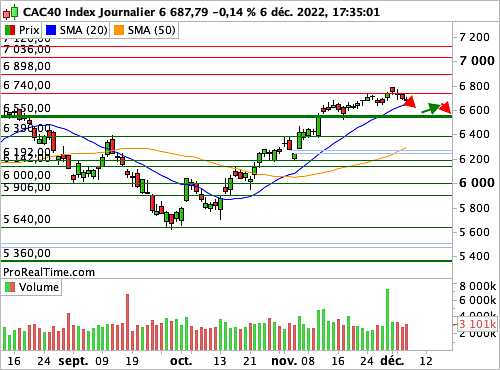

KEY GRAPHIC ELEMENTS

The prices of the flagship Parisian index are now at the top of a range between 6,550 points and 6,740 points, in which, until now, the beginnings of a chartist pattern were emerging. This would only continue in the event of a decline in the lateral channel. Conversely, a clear overshoot, on an uncontested gap for example, would pave the way for a rapid achievement of 6,900 points. In the immediate future, a new breath in prices below 6,740 points is the preferred scenario, which was confirmed by the content of the NFP report on Friday. Technically, there is no solid enough material support to oppose a consolidation towards 6,550 points..

FORECAST

In view of the key graphic factors that we have mentioned, our opinion is negative on the CAC 40 index in the short term.

This bearish scenario is valid as long as the CAC 40 index is trading below the resistance at 6740.00 points.

Hourly data chart

Chart in daily data

©2022 News Bulletin 247

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.