(News Bulletin 247) – Loyalty is as important in investment as in a romantic relationship, according to an analysis by the Etoro trading and investment platform.

Just as in romantic relationships, loyalty in investment matters is generally rewarded, according to a study* from broker Etoro which echoes Valentine’s Day this Wednesday, February 14, this holiday celebrating the patron saint of lovers.

For the broker, investors who commit for the long term have a high chance of having a successful relationship with their portfolio. Analyzing the returns of the S&P 500 between 1871 and 2024, Etoro indicates that the probability of obtaining a positive return by holding the managers’ flagship index for one year is 72%. This probability rises to 87% if it is held for 10 years, and to 95% for 20 years.

Similar trends are seen in data for the UK Allshare Index, the broker explains, with the probability of a positive return increasing from 66% for a single year and to 83% over a 20-year period.

“While all retail investors experience tough times with their investments, it’s those who commit to a long-term plan and stay the course who tend to reap the greatest rewards. As our data on S&P500 and the CAC40, it is better to stay in the markets rather than anticipate them, and returns improve considerably over longer periods,” notes Antoine Fraysse-Soulier, market analyst at Etoro.

Loyalty rewarded

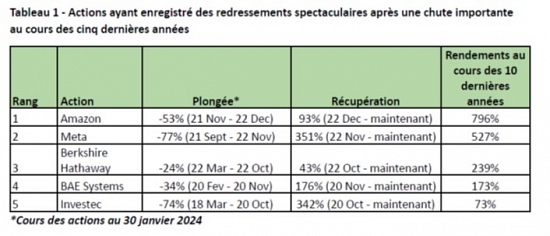

Etoro’s data also highlights the benefits of sticking with your investments during tough times. Companies such as Amazon, BAE Systems and Berkshire Hathaway delighted loyal investors after their stocks posted strong gains following significant declines.

The broker takes the example of Meta, which was then shunned by many investors after a plunge of 77% in 2021 and 2022. It has since rebounded by 351% in just over 12 months, posting an increase of 527%. % over ten years.

Etoro also cites Amazon, which for its part recorded a price increase of 796% over 10 years despite a plunge of 53% between November 2021 and December 2022.

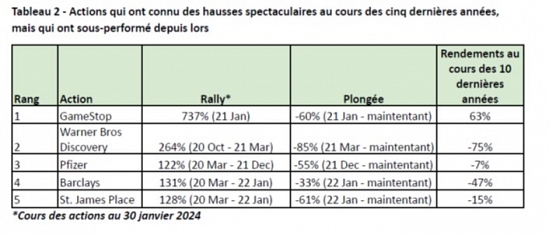

Conversely, Etoro’s analysis also highlights the dangers of getting carried away by “the excitement of a short-term adventure”. The broker cites the example of James’s Place, a British company providing advice and wealth management services. It had won the hearts of investors with spectacular triple-digit gains that quickly faded, leaving some of them facing significant losses.

The five commandments for a successful relationship with your wallet

Antoine Fraysse-Soulier offers investors his best advice for a fruitful relationship with their portfolio:

1. Emphasize initiative

You’ve probably watched other people around you do it, but maybe never dared to get started… Investing can seem intimidating at first, and getting started can seem like the hardest part. However, with the right knowledge, anyone can do it, and because returns compound over time, the earlier you start, the better.

2. Commit for the long term

The old adage “it’s time in the market that counts, not when you choose the market” still holds true. As with any relationship, there will be ups and downs, but history shows that loyalty is rewarded.

3. Keep your feet on the ground

It can be tempting to get carried away and become infatuated with a stock that’s in the spotlight. However, before putting all your eggs in one basket, you need to make sure you know the stock you are investing in and not let excitement take over.

4. Know what you are looking for

In love as in investing, it is crucial to know what you are looking for. Regardless of your personality type, it’s important to define your investment goals from the start in order to choose a portfolio that will help you achieve them.

5. Avoid hasty judgments

Beauty is just a matter of appearance. Before passing judgment on a company, you should be sure to research its historical performance, commitments and values. When it comes to investing, knowledge is power. Before buying a new stock, it is important to do your research.

*Etoro analyzed S&P 500 returns between 1871 and 2024, and UK returns since 1710. This process relied on the following sources: Online Data – Robert Shiller (yale.edu) and https:// fred.stlouisfed.org/graph/?g=pKEz

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.