(BFM Stock Exchange) – This article, with free access, is produced by the research team in BFM Stock Exchange analysis and market strategy. To not miss any opportunity, consult all of the analyzes and discover our portfolios by accessing our privilege space.

CAC 40 (+1.37% on Monday) managed to keep its earnings on Tuesday, in a context of appeasement in trade tensions between Washington and Beijing. For a period of 90 days, Washington will bring the customs duties imposed at 30% (against 145%), Beijing will lower them to 10% (compared to 125%). This reduction “is only temporary” mas The market thinks “that the worst of the trade war has passed and that the trend is in de -escalation”, underlines Deutsche Bank.

Please note, however, warns Thomas GIUDICI, head of bond management of Auris Gestion. “After the disappointment of the” Liberation Day “, the financial markets very (too much?) Quickly integrated an outcome favorable to the bilateral negotiations to come on customs duties.”

“Donald Trump will not come back to the very principle of customs duties and it therefore seems difficult to adopt a more optimistic posture than that already integrated by the markets. Above all, the concrete effects of the business war on the results of companies do not yet seem completely at the center of attentions.”

In the statistical chapter, good news for the ZEW index of trust in the first economy in the euro zone, which jumped at 25.2. “The expectations of expectations are improving. The ZEW indicator provides for a significant improvement in May 2025 and compensates for part of the losses observed during the April investigation. With the arrival of a new government, advances in the payment of tariff disputes and stabilization of inflation, optimism has strengthened,” comments the president of ZEW, Professor Achim Wambach.

The market took note last week from the election in the second round of Friedrich Merz, the leader of the CDU-CSU, as a German Chancellor. The political leader had failed to be elected in the first round.

The markets also learned of consumer prices in the United States, up 0.2% excluding food and energy in April, against expectations at +0.3%. This is the lowest pace since February 2021.

“American inflation was lower than forecasts in April. The threat of prices increased by customs duties moving away from recent agreements and advanced indicators of the housing sector indicating a slowdown in housing costs, the Federal Reserve will continue to envisage interest rates later in the year,” wrote Ing economists.

“The report on inflation (ICC) of April does not yet show an impact on customs duties decided by the new Trump administration. This should nevertheless materialize on the next, for example with the increase in the price of cars, and it is this prospect that makes the American Federal Reserve (Fed) will remain cautious”, advances, Bastien Drut, responsible for strategy and economic studies in CPRAM.

On the values side, GL Events resumed 5.8% after announcing the award of the French Stadium concession, a contract evaluated between 70 and 80 million euros in revenue by TP ICAP Midcap. Equasens jumped 12.2%, the specialist in software for professionals and health establishments unveiled an increased commercial activity over the first three months of 2025. Star of the day on Monday, Forvia continued to gain height, taking 5.34% at 8.52 euros. Since the beginning of the month, the action of the automotive supplier has been targeting 25% in a context of appeasement of trade tensions.

On the other side of the Atlantic, the main shares on shares finished the Tuesday session in dispersed order, the Dow Jones losing 0.64% and the composite Nasdaq managing to gain 1.61% above the 19,000 points. The S & P500, a reference barometer of appetite for the risk in the eyes of fund managers, gained 0.72% to 5,886 points.

A point on the other asset classes at risk: around 8:00 am this morning on the exchange market, the single currency was treated at a level close to $ 1,1190. The barrel of WTI, one of the barometers of appetite for the risk on the financial markets, was exchanged around $ 63.00. THE Treasuries 10 Yearsyield of federal sovereign bonds due to 10 years, was negotiated slightly above 4.47%. As for the Vix, it was worth 18.22 at the last fence of the S&P500.

At the macroeconomic agenda this Wednesday, to follow in priority the stocks of American crude at 4:30 p.m.

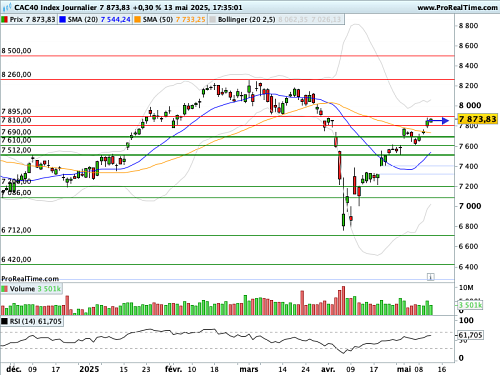

Key graphics elements

The opening gap, ample on Friday 02 May, showed a first shortness of breath of the catch -up movement initiated on April 08. From now on, the index is under strength of resistance, materialized, among other things by another GAP, downside this one: that of Thursday, April 03, the beginning of the vivid correction linked to the entry into force of prohibitive customs rights. This level is doubled from the mobile average at 50 days (in orange), which is a graphic test. This graphic test is currently in the process of being successful.

FORECAST

In view of the key graphic factors that we have identified, our opinion is neutral on the CAC 40 index in the short term.

We will take care to note that a crossing of the 7895.00 points would revive the tension to the purchase. While a break in the 7690.00 points would relaunch the selling pressure.

The News Bulletin 247 Council

Hourly data graphics

Daily data graphics

I have over 8 years of experience working in the news industry. I have worked as a reporter, editor, and now managing editor at 247 News Agency. I am responsible for the day-to-day operations of the news website and overseeing all of the content that is published. I also write a column for the website, covering mostly market news.