From Monday the applications – 500 million euros the cost of the program with provision for doubling – see tables for installments and interest rates

It starts next Monday, April 3the submission of applications to banks by young people and young couples, for the granting of interest-free or low-interest loans, with an interest rate corresponding to a quarter of the normal market interest rate, for the acquisition of a first home.

Through the program, more than 10,000 beneficiaries can within the year acquire a privately owned home with a monthly installment significantly lower than that corresponding to market mortgages, as 75% of the capital granted by DYPA is interest-free, while for those with three children and those with many children (and those who acquire this status during repayment) the loan is granted in its entirety interest-free. Thus, borrowers will have a significantly lower installment compared to mortgage loans granted by banks and, accordingly, a much smaller burden than any increases that have been or may be made in bank interest rates due to the international crisis.

For example, for a loan of 100,000 euros with a repayment period of 30 years and an interest rate of 5.8% (three-month Euribor plus 2.8%, which is an average margin charged by banks), the monthly installment is 587.52 euros. With the program subsidy, the installment is reduced to 342.87 euros, which means that the borrower’s benefit is 244.65 euros per month or 2,935 euros per year. If the borrower has many or three children, then the loan is interest-free and the installment is limited to 277.78 euros, that is, the benefit is 309.74 euros per month or 3,716.88 euros per year.

Example 1: €100,000 loan, repayment term 30 years

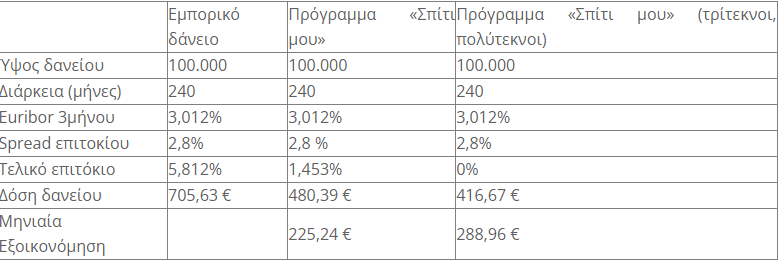

For the same loan with a repayment period of 20 years, the monthly installment is 705.63 euros and is limited to 480.39 euros according to the program (a benefit of 225.24 euros or 2,702 euros per year. For three children – many children, the installment is reduced to 416, 67 euros (a benefit of 288.96 euros or 3,467.52 euros per year).

Example 2: €100,000 loan, repayment period 20 years

The Minister of Labor and Social Affairs, Kostis Hatzidakis, he said: “With the new housing policy announced and already implemented by the government, we are giving a first answer to the housing problem faced by young people and young couples in particular. Applications for subsidized housing loans start next week, followed by the “Coverage” program to house vulnerable young people in private homes, with rent paid by the State, social benefits, and private home renovation programs. Our goal is to ensure affordable and quality housing for thousands of young and vulnerable households using European and national resources, utilizing public and private property and using the corresponding practices applied in the EU as a “guide”.

The Minister of State Akis Skertsos emphasized: “From Monday, first-timers can apply to banks to get their own home, something that was self-evident for previous generations but is more difficult for young people today. The cost of servicing the loan they will get from the bank thanks to the government subsidy is lower than the rent they would pay. This is the added value of the program that starts. It is a fact that Greece was for many years an inhospitable country for young people that did not give them the opportunities they should. We are also well aware that housing-related living costs are high compared to other European countries. The goal of our own policy is to reduce these costs and make the lives of citizens much easier, so that they choose to live, create and make a living in Greece, to feel again – especially the young – that the State is in their side”.

The Governor of DYPA Spyros Protopsaltis reported: “After 10 years, the new housing policy is now a fact, with DYPA supporting the acquisition of a first home through loans with low or no interest. Finally, available resources are being used to implement policies aimed at access to affordable housing, with a focus on young people. DYPA expands its social policy and activates the new responsibilities and new tools that were instituted almost a year ago with the Jobs Again law. We continue to support and empower young people to build their future.”

The total budget of the program is 500 million euros, with a provision for doubling in case of exhaustion of the available resources, while it is estimated that the beneficiaries will be 10,000 young people or young couples aged 25-39.

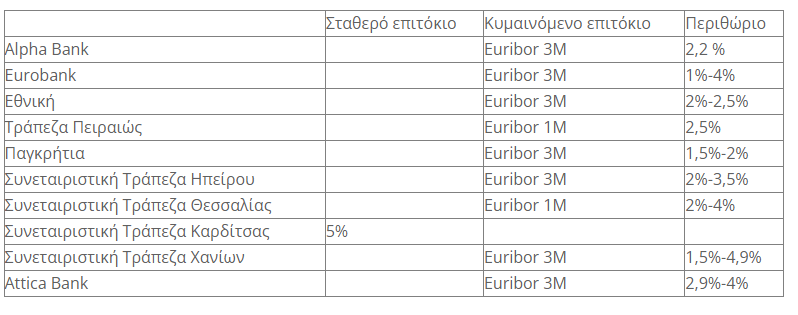

The housing loan program is part of the government’s “My Home” housing policy, established by law 5006/2022. The banks National, Piraeus, Alpha, Eurobank, Attica Bank, Pankritia, as well as the Cooperative Banks of Epirus, Thessaly, Karditsa and Chania participate in the program, which announced the initial interest rates for subsidized loans as follows:

The beneficiaries of the program

Beneficiaries of the program are persons aged, on the date of submission of the loan application, from 25 to 39 years old, or couples (one of them must meet the age criterion), provided that:

– They have an annual income of at least 10,000 euros up to the amount corresponding to receiving the heating allowance (16,000 euros for a single person, 24,000 euros for a couple plus 3,000 euros for each child, 27,000 euros for single-parent families plus 3,000 euros for each child beyond the first).

– They do not have a property that meets their housing needs.

The eligible properties are residences of commercial value (ie the value that will be stated in the purchase contract) up to 200,000 euros, with an area of up to 150 sq.m. and at least 15 years old, within a residential area. The amount of the loan cannot exceed 150,000 euros and the duration 30 years, while it can cover up to 90% of the value of the property.

The limits of loans and the commercial value of the houses were set with social criteria and taking into account the values of the properties in the market, in order to ensure the existence of available properties for sale with these characteristics. It should be pointed out that a recent survey by a network of real estate offices certified the existence of a large number of available houses with an area of 75-150 sq.m. and worth up to 200,000 euros both in the center and in the suburbs. In addition, based on the objective values (which concern newly built properties while the mortgage loan program concerns 15-year properties, the values of which are obviously lower compared to newly built properties) it appears that in dozens of areas (indicative: Agia Paraskevi, Marousi, Pefki, 4th Municipal District of Thessaloniki-Toumba, etc.) the 200,000 euros correspond to houses of 90-150 sq.m.

Additional advantages of the loans that will be disbursed under the program are that:

– The loan is exempt from the levy of Law 128/1975 which is currently 0.12%.

– The program covers the program covers the envelope costs for each potential borrower.

– It is not allowed to request a third party guarantee for the granting of the loan.

The MLA that has already been issued provides for specific deadlines for the completion of the procedures (selection of a bank by the beneficiaries, review of criteria, pre-approval, technical and legal control of the property, notification to the Hellenic Development Bank (HDB), signing of the loan agreement and disbursement of the loan) in order to accelerate the implementation of the program. The signing of the loan agreement and the disbursement of the amount must have taken place within a period of six months from the approval of the application by the ETA.

Source: Skai

I have worked as a journalist for over 10 years, and my work has been featured on many different news websites. I am also an author, and my work has been published in several books. I specialize in opinion writing, and I often write about current events and controversial topics. I am a very well-rounded writer, and I have a lot of experience in different areas of journalism. I am a very hard worker, and I am always willing to put in the extra effort to get the job done.