The interest spread between existing deposits and loans increased to 3.91 percentage points.

The “gap” between interest rates on deposits and loans opens at 4.56 points. Details of her Bank of Greece show an unchanged weighted average new deposit rate at 0.04% versus an average new loan rate of 4.60%, a significant increase of 60 basis points.

The interest spread between existing deposits and loans increased to 3.91 percentage points.

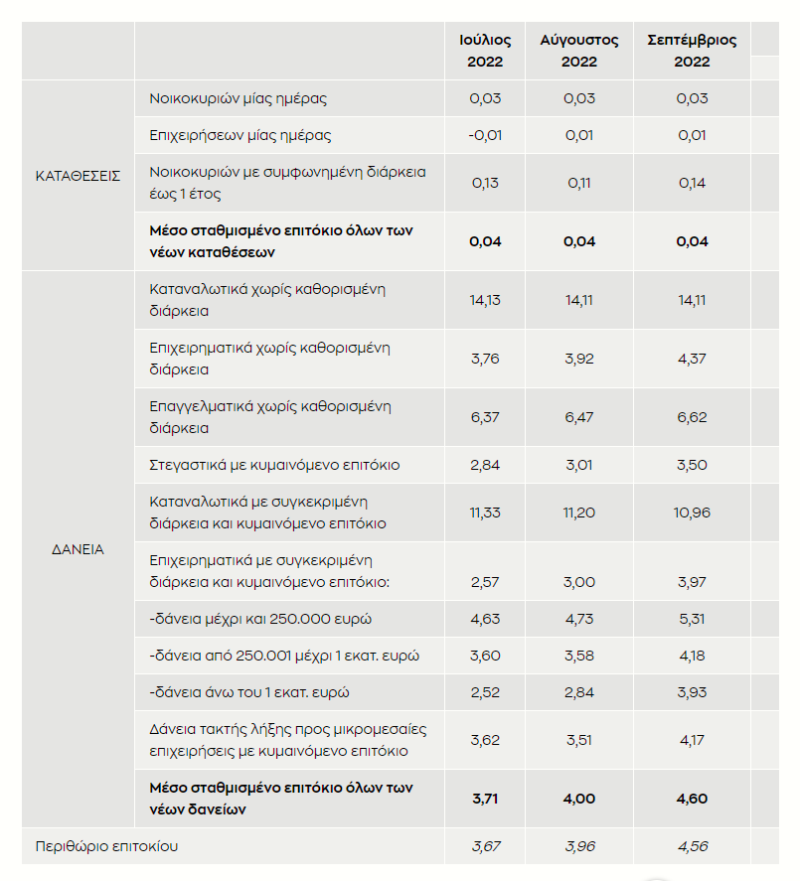

1. Interest rates on new deposits and loans in euros

New Deposits

The weighted average interest rate on all new deposits was unchanged at 0.04%.

In particular, the average overnight deposit rates from households and businesses remained unchanged at 0.03% and 0.01% respectively. The average interest rate on deposits with an agreed term of up to 1 year from households increased to 0.14% from 0.11% in the previous month.

New Loans

The weighted average interest rate of all new loans to households and businesses increased by 60 basis points and stood at 4.60%.

In particular, the average interest rate on consumer loans without a fixed term (a category that includes credit card loans, open loans and overdrafts from current accounts) remained unchanged at 14.11%.

The average interest rate on consumer loans with a fixed term and floating rate decreased by 24 basis points and stood at 10.96%. The average interest rate on variable rate mortgages increased by 49 basis points to 3.50%.

The average interest rate on non-fixed business loans rose 45 basis points to 4.37%. The corresponding interest rate on professional loans increased by 15 basis points and stood at 6.62%.

The average interest rate on new fixed-term and floating-rate business loans increased by 97 basis points in September 2022 to 3.97%. The average interest rate on regular maturity loans with a variable interest rate to small and medium enterprises (SMEs) increased by 66 basis points and stood at 4.17%.

Regarding the structure of interest rates in terms of the amount of the loan, it is noted that the average interest rate for loans up to 250,000 euros increased by 58 basis points to 5.31%, for loans from 250,001 to 1 million euros it increased by 60 basis points and stood at 4.18% and for loans over 1 million euros it increased by 109 basis points to 3.93%.

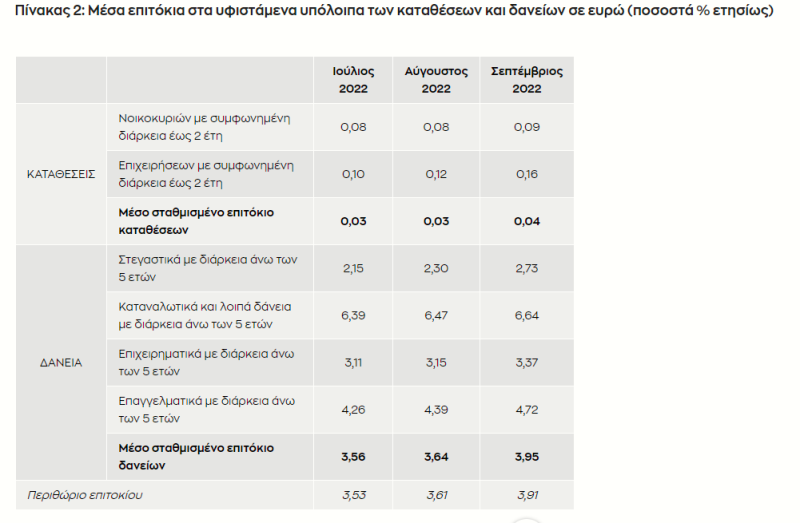

2. Interest rates on existing deposit and loan balances in euros

Existing Deposits

The weighted average interest rate on total outstanding deposits (including overnight deposits) remained almost unchanged at 0.04%.

In particular, the average interest rate on the existing balances of deposits with an agreed duration of up to 2 years from households remained almost unchanged at 0.09%, while the corresponding interest rate on deposits from businesses increased by 4 basis points and stood at 0.16%.

Existing Loans

The weighted average interest rate on existing loans increased by 31 basis points to 3.95%.

In particular, the average interest rate on existing mortgage loan balances with a duration of more than 5 years increased by 43 basis points and stood at 2.73%. The corresponding interest rate on consumer and other loans to individuals and private non-profit institutions increased by 17 basis points and stood at 6.64%.

The average interest rate on business loans with a term of more than 5 years increased by 22 basis points to 3.37%. The corresponding interest rate on professional loans increased by 33 basis points and stood at 4.72%.

Read the News today and get the latest news.

Follow Skai.gr on Google News and be the first to know all the news.

I have worked in the news industry for over 10 years and have been an author at News Bulletin 247 for the past 5 years. I mostly cover technology news and enjoy writing about the latest gadgets and devices. I am also a huge fan of music and enjoy attending live concerts whenever possible.