11 people were arrested, of which 10 are members of the criminal organization, including the three leaders – More than 1,500,000 euros were seized from virtual business accounts

In dismantling a criminal organization that was responsible for tax frauds exceeding 15 million euros while tax evasion is valued at 70 million euros the Police proceeded.

The members of the organization proceeded to setting up non-existent companies using forged documents and then depriving the state of millions in revenue as they performed cross-border VAT fraud and proceeded to fraudulently receive refundable advances.

❗A criminal organization for tax fraud was dismantled

📍Over 15 million euros their booty and 70 million tax evasion

📍They were setting up non-existent companies 🔗10 members were arrested, of which the three leaders

💵 More than 1,500,000 euros were pledged

👉https://t.co/v2inYwZItn pic.twitter.com/rP7aO1D7NX— Hellenic Police (@hellenicpolice) December 13, 2023

11 people were arrested, of which 10 are members of the criminal organizationincluding all three principal ones. Over 1,500,000 euros were pledged from virtual business accounts.

A criminal case was filed against them -as the case may be- for criminal organization, forgery, ongoing fraud against the Greek State and the financial interests of the European Union, money laundering from criminal activities, and for violation of the laws on weapons, harmful drugs and the National Customs Code, while , at the same time, twenty-three people are still included in the case file.

To achieve their illegal purpose, the members of the organization:

–they used forged documents and false statements to set up the companieswhile they submitted false rental declarations to the Independent Public Revenue Authority,

–declared as the headquarters of the companies premises in which they never settled and did not develop commercial activity,

–used “straw men” or details of natural persons not related to legal entitiesas administrators/representatives of the companies,

– through these elements, they issued VAT numbers and obtained Taxisnet codes,

–registered the data in the General Commercial Register,

– declared on electronic platforms alleged leases of business premises-headquarters of the companies, submitted tax declarations and applied for the relevant grant applications for -allowable advance payment and

–were proceeding to open corporate bank accounts and associated bank cards and issued electronic banking codes.

How did the criminal organization operate?

In particular, as regards the fraud concerning VAT, the companies managed by the members, issued virtual documents of VAT value. -16,000,426.39- euros and received fictitious documents worth -13,545,119.26- euros, for domestic transactions and for intra-Community deliveries, while making the corresponding bank payments for the sham payment of the value of the fictitious invoices and submitted false VAT returns.

Through this process, the members collected a total of -5,426,106- euros, as a VAT refund. for virtual deliveries of goods, while as it turned out, they imported products worth -70,000,000- euros from member states of the European Union, managing to appropriate the corresponding VAT. worth -13,548,387- euros.

Regarding the fraudulent disbursement of the refundable advance, using tricks and exploiting the infrastructure of the companies, their experience and the constant monitoring of accounting procedures, illegally became beneficiaries of this financial aid through false, inaccurate or incomplete VAT declarations. as well as gross turnover.

In this way, the organization made -sixty-nine- entities illegal beneficiaries of the aidreceiving a total of -9,695,525.34- euros, while through another -13- companies they tried to collect an additional -3,582,066- euros.

To legitimize their income, they had set up a labyrinthine interbank channel consisting of -131- bank accounts. Through them and making -52,539- bank transactions, they transferred the amounts they collected from -133- refundable advances and -44- VAT refunds. to accounts of companies based in member states of the European Union and active in the trade of technology devices. Also, they were buying luxury vehicles and technology products.

In fact, a characteristic of the level of preparedness and high level of expertise of the criminal organization in question is that its members, only for the months of September and October 2023, set up -30- virtual businesses, in order to join a subsidized Program of the European Union.

It is noted that, a key member of the organization in the field of procurement with forged documents which were used to set up the companies was arrested on 18-05-2023 by the Economic Police Directorate as he was wanted with arrest warrants and was being prosecuted for convictions, for tax evasion through non-payment of VAT, forgery and forming – joining a criminal organization for distinguished case of drug trafficking.

What did the authorities seize?

During the physical searches and the searches carried out in homes and businesses in total, the following were found and seized:

-54,186- euros,

-2- pistols,

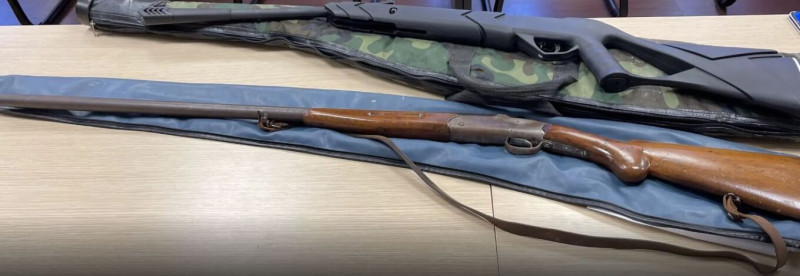

-2- carbines,

-number of cartridges and magazines,

-6- knives, iron fist,

-8- luxury vehicles,

-59,989- prohibited medicinal tablets,

-171- electronic cigarettes and

-number of mobile phones

The arrested were taken to the Greek Office of European Prosecutors.

Source: Skai

I have worked as a journalist for over 10 years, and my work has been featured on many different news websites. I am also an author, and my work has been published in several books. I specialize in opinion writing, and I often write about current events and controversial topics. I am a very well-rounded writer, and I have a lot of experience in different areas of journalism. I am a very hard worker, and I am always willing to put in the extra effort to get the job done.