The increased energy costs are a big shock for the competitiveness of the European economies, especially in relation to countries with low energy costs, such as the USA, analysts emphasize

Unlike the pandemic, which proved to be a temporary blow to economies, the European energy crisis is a long-term and structural risk that threatens the economies’ potential growth, warns the Moody’s. According to the rating agency, the economies most at risk of being permanently damaged by the energy crisis are those of Central and Eastern Europe, as well as Italy.

In her case Greece, the long-term damage to the economy from this crisis is mainly due to its high exposure to tourism (15% of GDP), which makes it vulnerable to a possible reduction in household incomes. Moody’s analysts also mention the great importance of small and very small businesses in the production of added value and employment in Greece as a risk factor.

Greece is exposed to a moderate risk of permanent damage from this crisis due to its weak fiscal position, the higher risk of a credit event in the banking sector and its weak institutions.

The crisis will last

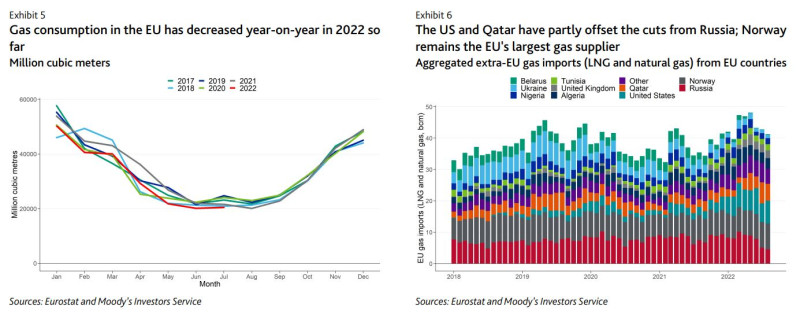

Moody’s warns that the energy crisis will last, even though natural gas prices have now come down from summer highs. A prolonged period of geopolitical uncertainty, combined with the need for a structural overhaul of Europe’s energy mix, means that energy prices will remain above historical levels in the medium term.

The increased energy costs are a big shock for the competitiveness of the European economies, especially in relation to countries with low energy costs, such as the USA, analysts emphasize. “This disadvantage could weaken the region’s long-term price competitiveness and lead to the structural decline of the European Union’s industrial base in the medium term, if there is no effective government support,” they note.

At the same time, the risk of bond enforcement is expected to act as a deterrent to investment until alternative supplies are secured. Moody’s estimates that sufficient energy storage and reduced consumption will allow most countries to avoid an energy crunch this winter, but risks will remain elevated until governments can find reliable and long-term alternatives to Russian supplies. which according to the house, will require years.

The most exposed economies

According to Moody’s, the economies of Central and Eastern Europe and of the large ones, those of Italy and Germany, are the most exposed to the risk of permanent damage (scarring) from the energy crisis, due to their high dependence on industry and sectors that are vulnerable to increased energy costs.

Moody’s notes that Southern European countries have moderate exposure, mainly through spillover effects in service sectors such as tourism. The high number of small firms, which typically have smaller liquidity cushions to absorb increased costs but less diversification, is also a risk factor.

In the end, the effectiveness of policies will judge the effects of this crisis, concludes the house, noting that the fiscal and institutional strength of each country will depend on whether a government has room to take measures and how effective these measures will be. .

moneyreview.gr

Read the News today and get the latest news.

Follow Skai.gr on Google News and be the first to know all the news.

I have worked in the news industry for over 10 years and have been an author at News Bulletin 247 for the past 5 years. I mostly cover technology news and enjoy writing about the latest gadgets and devices. I am also a huge fan of music and enjoy attending live concerts whenever possible.