“The goal of the provision is primarily to ensure the level of pensions of the self-employed,” said the Deputy Minister of Labor and Social Security, Panos Tsakloglou

His decision was signed Deputy Minister of Labor and Social Security, Panos Tsakloglou to determine the insurance contributions of the self-employed as provided by law 4670/2020, according to which the maximum limit of insurable earnings for the calculation of the monthly insurance contribution of employees and employers is increased by 3.46% for the current year and is formed in the amount of 7,373.88 euros.

According to Law 4670/2020, the insurance contributions of the self-employed, freelancers and farmers are adjusted for the current year based on the average inflation of the previous year. It is noted that the projected increases are quite low, as our country has managed to keep inflation at low levels despite intense inflationary pressures internationally.

It is reminded that the law of Katrougalos linked self-employed contributions to taxable income while the Vroutsi insurance law led to the change of the self-employed contribution system from January 1, 2020, disconnecting them from taxable income and provided for the freezing of contributions for the years 2021 and 2022 at the original height.

The new contributions apply from 1 January 2024 and are scaled across six different classes. The insured have the possibility to freely choose the class of contributions they will pay.

In particular, the insurance categories are set up for 2024 as follows:

A. For freelancers and the self-employed

B. For the farmers

C. For supplementary insurance and lump sum

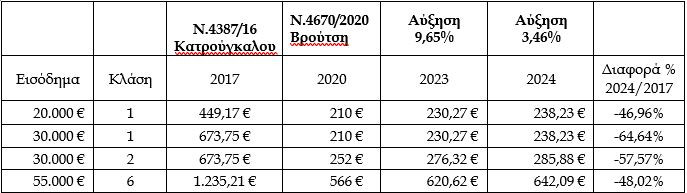

The following is a comparative Table with indicative examples of the amount of self-employed contributions, as formed under SYRIZA with the Katrougalou law compared to the Vroutsi law in 2020 and the current year 2024.

The examples show that the contributions in 2024 after the adjustment continue to be significantly lower than those imposed in 2017 by the Katrougalou Law.

THE Deputy Minister of Labor and Social Security, Panos Tsaklogloustated:

According to the current law, the contributions of the self-employed and self-employed insurance classes are increased by the rate of change of the average inflation of the previous year, i.e. by 3.46%.

The aim of the above provision is primarily to ensure the level of self-employed pensions. Potentially ignoring inflation in contributions will mathematically lead to lower pensions in the future.

Our insurance system is distributive which practically means that the pensions of current pensioners are covered to a significant extent by the contributions of active insured persons. Every adjustment of the pensions should therefore be covered by corresponding contributions to the insurance funds.

Otherwise the insurance system would once again enter a vicious cycle of increasing deficits with obvious risks to its sustainability.

Source: Skai

I am Janice Wiggins, and I am an author at News Bulletin 247, and I mostly cover economy news. I have a lot of experience in this field, and I know how to get the information that people need. I am a very reliable source, and I always make sure that my readers can trust me.